Welcome to CLPHA's Press Room

CLPHA experts welcome interview requests from print, radio, television, and online reporters and are happy to provide their insights on issues of public housing and related legislation and policy.

For media inquiries, please contact:

David Greer

Director of Communications

(202) 550-1381 or [email protected].

*Please let us know if you are working on deadline.

To view all of CLPHA's press releases, click here.

To view all of CLPHA's press statements, click here.

You can subscribe here to our biweekly newsletter, events invite list, and topic specific newsletters. You can also follow us on Twitter at @CLPHA. Or, send us an email with your interests and we would be happy to add you to our press lists.

Thanks again for your interest in CLPHA!

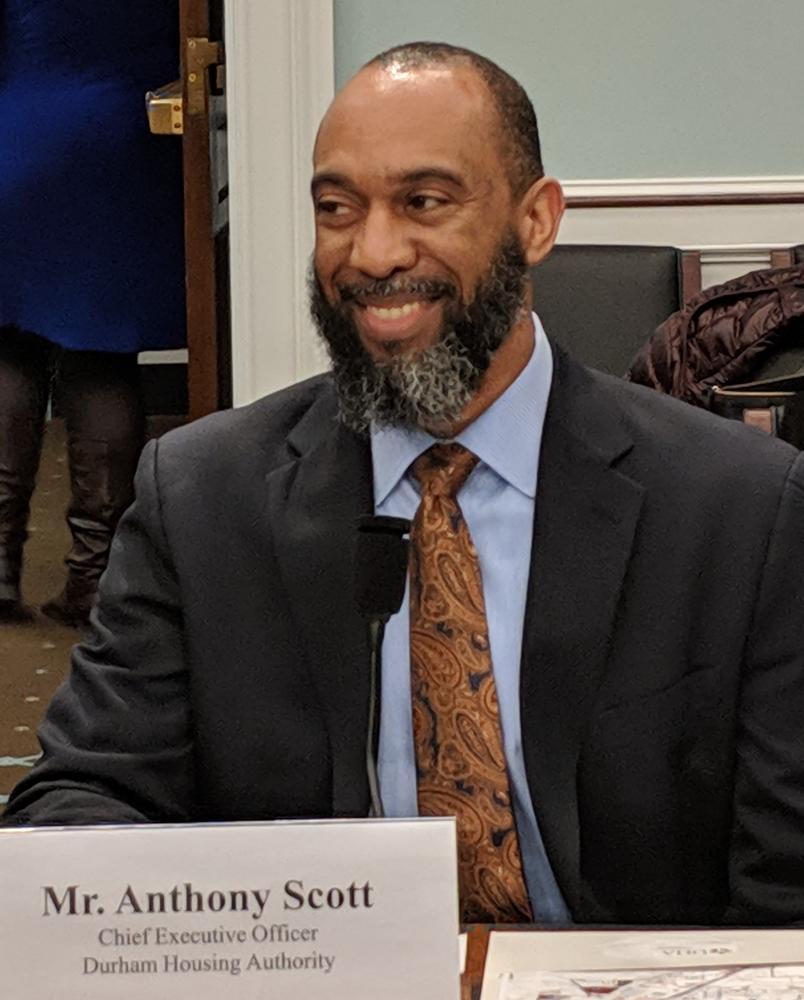

DHA CEO Anthony Scott Testifies Before House Appropriations Subcommittee on Behalf of the Council of Large Public Housing Authorities: Aggressive Action is Needed to Undertake Affordable Housing Production and Preservation

WASHINGTON (March 7, 2019) – This morning, Durham Housing Authority CEO Anthony Scott testified on behalf of the Council of Large Public Housing Authorities before the House Appropriations Subcommittee on Transportation, Housing and Urban Development, and Related Agencies during its hearing, “Stakeholder Perspectives: Affordable Housing Production.” Scott emphasized the critical need for reinvestment in the nation’s Public Housing and Section 8 Housing Choice Voucher programs, which are the foundation of the affordable housing market.

“As a nation, we are now at a critical stage for needing aggressive action to undertake affordable housing production and preservation,” testified Scott.

In addition to calling for increased appropriations to the public housing capital and operating funds, Scott urged Congress to combat the affordable housing shortage by providing housing authorities greater flexibility to preserve and transform public housing through the Rental Assistance Demonstration Program, the Moving to Work program, and with selected and targeted flexibilities through a defined statutory process.

“Fundamentally, the RAD program allows DHA to create mixed-use and mixed-income communities that allow a more diverse socio-economic living environment,” testified Scott. “Our barriers are a RAD program that doesn’t allow enough flexibility to fully leverage development opportunities with private sector development… The private market moves at a faster pace and waiting on a RAD approval to transfer units could result in a missed opportunity.”

Scott also recommended Congress eliminate the Faircloth Amendment, which prohibits the development of new public housing units; invest in broad place-based solutions such as the Choice Neighborhoods Initiative to address neighborhood and community development needs; encourage greater interdepartmental collaboration to facilitate cross-sector partnerships with housing; and distinguish public and affordable housing as an integral part of the national infrastructure.

“We thank Chairman Price for inviting CLPHA and Mr. Scott to participate in today’s hearing, and for recognizing that public housing authorities are essential to local housing markets as the owners and operators of most of the assisted housing that serves extremely low-income households while generating wide reaching economic impacts,” said CLPHA Executive Director Sunia Zaterman. “We look forward to working with the committee to increase support for public and affordable housing programs that provide decent housing to the nation’s most vulnerable citizens, connect low-income workers to economic opportunities, and spur regional job creation and economic growth.”

Along with Scott, representatives from the North Carolina Housing Finance Agency and National Housing Trust were invited to participate in the Appropriations Subcommittee hearing.

The testimony is posted to the Committee website and the live-stream recording of the hearing can be viewed on the Committee's YouTube channel.

About the Council of Large Public Housing Authorities

The Council of Large Public Housing Authorities is a national non-profit organization that works to preserve and improve public and affordable housing through advocacy, research, policy analysis and public education. CLPHA’s 70 members represent virtually every major metropolitan area in the country. Together they manage 40 percent of the nation’s public housing program; administer more than a quarter of the Housing Choice Voucher program; and operate a wide array of other housing programs. Learn more at clpha.org and on Twitter @CLPHA and follow @housing_is for news on CLPHA’s work to better insect the housing field and other areas of critical importance such as health and education.

###

Washington, DC – Members of the Campaign for Housing and Community Development Funding (CHCDF) hosted a national call with over 2,200 registrants yesterday, January 15, about the effects of the partial government shutdown on low-income people and communities and the affordable housing programs that serve them.

Experts from multiple affordable housing organizations shared information on the shutdown’s impact on federal affordable housing and community development programs and emphasized that the longer the shutdown continues, the more negatively it will impact people with the lowest incomes – seniors, people with disabilities, and families with children. Panelists spoke about the shutdown’s effects on public housing, project-based rental assistance, housing vouchers, rural housing, and housing and services for seniors, people with disabilities, the homeless, and those at risk of homelessness.

The panel encouraged listeners to contact their members of Congress and tell them to vote now—before residents in federally assisted housing experience rent hikes and evictions—to reopen the federal government and pass clean fiscal year 2019 spending bills. Listeners were also urged to encourage their members of Congress to sign onto a “dear colleague” letter led by Senator Mark Warner (D-VA) and Representative Marc Veasey (D-TX) to be sent to President Trump on the shutdown’s severe consequences for affordable housing.

“Nearly 700 property owners that have HUD contracts to operate housing affordable to the lowest-income seniors, people with disabilities, and families with children have seen those contracts expire due to the shutdown, and more will expire this month and next,” said NLIHC President and CEO Diane Yentel. “These contract suspensions put the homes of nearly 70,000 low-income renters at risk of serious rent hikes and evictions. HUD has asked owners of these properties to dip into their savings, if they have any, to cover the costs. Some will be able to do so, but not forever, and some have already communicated to their tenants that rent hikes are coming. The longer the shutdown goes on, the more untenable it will become for properties owners to keep scraping by without their federal contracts - and the more the lowest-income renters will suffer.”

“Public housing authorities, which are responsible for housing over 3 million low-income households nationwide, are doing everything they can to keep things running during this period of tremendous uncertainty, but it is unclear how long they can continue with business as usual for residents and landlords,” said Council of Large Public Housing Authorities Executive Director Sunia Zaterman. “Without a guarantee from HUD that funding will be available in March, many PHAs will need to notify landlords and residents next month that delayed payments are a possibility. Anxious residents and landlords fearful of missed payments, combined with other cascading impacts due to lack of staffing at HUD, including program grants not being renewed and affordable housing development deals not being approved, amount to an unmitigated disaster for millions of low-income families.”

“As the budget stalemate continues, the impact on small towns and rural families grows more severe. Everyday Americans are losing out on billions of dollars’ worth of affordable housing, clean drinking water, and community facilities, like town halls, fire stations and hospitals,” said Housing Assistance Council CEO David Lipsetz.

“HUD has made clear already, in December, [it has] not renewed 224 contracts for rental assistance in Section 202 Housing for the Elderly communities, and more are set to expire in January,” said LeadingAge President and CEO Katie Smith Sloan.“LeadingAge’s members, all nonprofits, rely on regular and adequate funding to provide quality affordable housing to some of the nation’s lowest-income older adults. The average older adult in HUD’s Section 202 Housing for the Elderly program has an annual income of $13,300, an income far too little to make ends meet in any private housing market. More than 400,000 older adults rely on the Section 202 program, while another 1.2 million rely on other HUD programs for housing assistance. We urge Congress and the White House to end the shutdown so that . . . these 1.6 million older adults have the stable housing they need to age with dignity.”

“The shutdown’s impacts range far beyond Washington, DC,” said National Association of Housing and Redevelopment Officials CEO Adrianne Todman. “It’s hurting workers, small businesses, farmers, and housing providers across the country. Housing providers are struggling with contingency plans to make repairs to units and to pay landlords in the voucher program. And guess who will suffer the most? The low-income families and seniors who rely on a functioning federal government. They are at risk now and will be at even greater risk as the shutdown continues. If any of these families are harmed by the shutdown, the blame lays squarely at the feet of the White House and the Congress.”

“Every day that it drags on, the needless government shutdown threatens more low-income seniors, people with disabilities, and seniors who rely on critically important federally assisted affordable housing,” said National Housing Trust Federal Policy Director Ellen Lurie Hoffman. “Private rental housing owners are scrambling to cover operating costs for which the federal government is contractually responsible, with no end in sight.”

Listen to the CHCDF national call on the impacts of the shutdown on affordable housing programs and community development at: https://bit.ly/2DersVM

Read NLIHC’s latest update on the shutdown at: https://bit.ly/2AzHoju

Check out NLIHC’s interactive map and a state-by-state breakdown of how the shutdown is impacting some HUD-assisted housing.

###

About the Council of Large Public Housing Authorities (CLPHA): The Council of Large Public Housing Authorities is a national non-profit organization that works to preserve and improve public and affordable housing through advocacy, research, policy analysis and public education.

About National Low Income Housing Coalition (NLIHC): Established in 1974 by Cushing N. Dolbeare, the National Low Income Housing Coalition is dedicated solely to achieving socially just public policy that assures people with the lowest incomes in the United States have affordable and decent homes.

About Campaign for Housing and Community Development Funding (CHCDF): An education, strategy and action hub led by NLIHC. The coalition of more than 70 national organizations works to ensure the highest allocation of resources possible to support affordable housing and community development. CHCDF’s members represent a full continuum of national housing and community development organizations, including faith-based, private sector, financial/intermediary, public sector and advocacy groups.

A coalition of more than 70 national organizations tell the Administration & Congress that people with the lowest incomes will be hit hardest if the shutdown continues.

Washington, DC - Members of the Campaign for Housing and Community Development Funding (CHCDF) sent a letter to congressional leaders today calling on them to protect low-income Americans by ending the government shutdown and passing full-year spending bills that provide strong funding for affordable housing and community development programs.

CHCDF, a coalition led by the National Low Income Housing Coalition, expressed strong concern for the shutdown’s immediate and long-term impacts on affordable housing programs and the low-income people they serve. The letter also called out the shutdown’s impact on the housing stability of low-wage government contractors, like janitors, security guards, and cafeteria servers, who often live paycheck-to-paycheck. These individuals working without pay are at risk of being unable to cover their rent payments, putting them at risk of eviction.

The government shutdown is thwarting critical investments in local communities and in affordable and accessible housing for low-income families, threatening to destabilize over four million households that depend on HUD’s rental assistance programs and creating widespread uncertainty for affordable housing investors.

“The longer the shutdown continues, the more the lowest income people will be hard hit,” said NLIHC President and CEO Diane Yentel. “Residents living in HUD-subsidized properties are some of our country’s most vulnerable people - the clear majority are deeply poor seniors, people with disabilities, and families with children. They rely on government assistance to remain housed, and a prolonged government shutdown puts them at increased risk of eviction and potentially homelessness. It’s incredibly reckless to risk the homes of our country’s lowest-income and most vulnerable people as perceived leverage for a border wall.”

“The partial government shutdown is a disaster for the millions of low-income families, seniors, and people with disabilities who depend on HUD assistance for safe, stable housing,” said Council of Large Public Housing Authorities Executive Director Sunia Zaterman. “Funding uncertainty puts more than two million voucher households at risk of losing their homes, and a lack of operating fund payments will force public housing authorities to shut units that cannot be repaired or properly maintained.”

“The bottom line for us is care and concern for the people we serve, and the shutdown hurts them,” said CSH President and CEO Deborah De Santis. “Every hour the deadlock drags on means people who really need housing and services are not going to get them. And the longer critical agencies stay shuttered the more likely it is families, children and other individuals now counting on help to stay housed and healthy will have their lifelines cut off.”

“Each day of the shutdown makes it harder and harder for the nearly 10 million people who live in HUD-assisted housing – low-income families, people with disabilities, veterans, and the elderly – to avoid eviction, keep their heat turned on, and access health care and supportive services,” said Enterprise Community Partners President Laurel Blatchford. “Congress and the Administration must find a way to restore funding for programs critical to the livelihoods of Americans across the country.”

“As the shutdown continues, HUD has made clear it will become unable to renew rental assistance contracts for housing providers,” said LeadingAge President and CEO Katie Smith Sloan. “LeadingAge’s members, all nonprofits, rely on regular and adequate funding to provide quality affordable housing to some of the nation’s lowest-income older adults. The average older adult in HUD’s Section 202 Housing for the Elderly program has an annual income of $13,300, an income far too little to make ends meet in any private housing market. More than 400,000 older adults rely on the Section 202 program, while another 1.2 million rely on other HUD programs for housing assistance. We urge Congress and the White House to end the shutdown so that each of these 1.6 million older adults have the stable housing they need to age with dignity.”

“Local governments rely on consistent contact with HUD in order to ensure reliable funding for services, projects and developments funded with grant programs like the Community Development Block Grant (CDBG) and HOME Investment Partnerships program,” said National Association for County Community and Economic Development Executive Director Laura DeMaria. “These programs provide vital services and resources to low-income families across the country. As long as HUD remains shut down, local governments, their community partners, and the low-income families they serve will lack the stability and constant flow of funds they need to operate.”

“This shutdown is hurting families across the country whether or not they work for the federal government and prolonging it will make matters worse,” said NAHRO CEO Adrianne Todman. “Capital expenses that require approval from HUD employees are left undone, and housing vouchers are not reaching families in need as housing agencies curtail additional spending. We should be especially concerned about the public- and private-sector landlords in the project-based rental assistance program who are left without funding and/or contract renewals. Those who can are already dipping into their reserves to make repairs and respond to their residents’ needs, but these reserves only go so far. This is unacceptable. End the shutdown.”

“Vulnerable Americans are the casualty of the current political battle. As a partial federal shutdown drags on, essential federal housing programs and tenant protections are in jeopardy,” said National Housing Law Project Executive Director Shamus Roller.

“The needless government shutdown has put the lowest-income residents at risk and left private rental housing owners scrambling to cover operating costs for which the federal government is contractually responsible,” said National Housing Trust Federal Policy Director Ellen Lurie Hoffman. “This threatens seniors, people with disabilities, and families who are struggling to make ends meet, as well as the viability of critically important affordable housing properties.”

Read the complete letter outlining the impact of the shutdown on specific affordable housing programs at: https://bit.ly/2RkB8Xd.

###

About the Council of Large Public Housing Authorities: The Council of Large Public Housing Authorities is a national non-profit organization that works to preserve and improve public and affordable housing through advocacy, research, policy analysis and public education.

About National Low Income Housing Coalition (NLIHC): Established in 1974 by Cushing N. Dolbeare, the National Low Income Housing Coalition is dedicated solely to achieving socially just public policy that assures people with the lowest incomes in the United States have affordable and decent homes.

About Campaign for Housing and Community Development Funding (CHCDF): An education, strategy and action hub led by NLIHC. The coalition of more than 70 national organizations works to ensure the highest allocation of resources possible to support affordable housing and community development. CHCDF’s members represent a full continuum of national housing and community development organizations, including faith-based, private sector, financial/intermediary, public sector and advocacy groups.

|

(Washington, D.C.) August 4, 2021: Statement from CLPHA Executive Director Sunia Zaterman on the extension of the CDC’s eviction moratorium:

“The Center for Disease Control’s order to extend the eviction moratorium in areas where COVID infections are rapidly rising is a welcome development that will keep millions housed while also decreasing the spread of the infectious Delta variant. CLPHA applauds the efforts of Congresswoman Maxine Waters (D-CA) for sounding the alarms as the current moratorium extension wound down and Congresswoman Cori Bush (D-MO), whose personal experience with being evicted grounded her sleep-in protest on the Capitol steps in an authentic voice that resonated with Congressional leaders, the White House, and everyday Americans.

“Throughout the pandemic, mission-driven housing authorities have been committed to preventing as many evictions as possible and only considering them as a last resort. CLPHA has advocated for emergency rental assistance during the pandemic as the most effective way to keep low-income families in their homes by providing assistance to tenants and property owners. The $46 billion that Congress allocated for emergency rental assistance as part of two COVID relief packages was one of the first relief programs to adequately meet the need caused by the pandemic. While the distribution of the relief funds has been uneven, CLPHA will take every opportunity during the 60-day extension to work with Congress and the administration to expedite the distribution of emergency rental assistance of behalf of tenants and landlords so that there no need for another moratorium.”

|

|

|

|

|

||

|

|

||

|

About the Council of Large Public Housing Authorities

About CLPHA’s Housing Is Initiative |

||

|

(202) 550-1381

For Immediate Release

July 30, 2021 (Washington, D.C.) July 30, 2021 – CLPHA Executive Director Sunia Zaterman released the following statement upon the scheduled end of the Centers for Disease Control and Prevention’s (CDC) nationwide eviction moratorium on July 31, 2021:

“While millions of low-income households are facing the threat of homelessness with the eviction moratorium scheduled to end this week, public housing authorities are committed to using every tool and resource available to keep residents safely housed. Public housing authorities understand that keeping people housed is the most cost-effective approach to prevent homelessness. Evictions are expensive, burdensome, and time consuming, and they increase turnover and vacancy costs for housing authorities. Furthermore, evictions are a soul-crushing experience that impacts every aspect of one’s life and are a significant contributor to long-term unemployment and homelessness.

“Throughout the pandemic, housing authorities have connected at-risk residents with additional support and services, including obtaining emergency rental assistance. The good news is the Treasury-administered Emergency Rental Assistance Program has increased the speed of its fund distribution. We know that more can be done to streamline access to funds by partnering with local housing authorities to help those assisted households in need.

“Congress funded emergency rental assistance programs because they are the most cost-effective measure to avoid the destructive and demoralizing process of evictions and prevent poverty. We urge the Treasury and Housing and Urban Development Departments and the White House to continue to work closely together to distribute emergency rental assistance as quickly and efficiently as possible to stem the tide of evictions.”

|

|

|

|

|

||

|

|

||

|

About the Council of Large Public Housing Authorities

About CLPHA’s Housing Is Initiative |

||

|

(Washington, D.C.) June 17, 2021 – The nation's leading advocacy organizations representing public housing authorities have come together to support universal housing vouchers. The Council of Large Public Housing Authorities, the Moving to Work Collaborative, the National Association of Housing and Redevelopment Officials, and the Public Housing Authorities Directors Association have released the joint letter below:

"Safe, secure, and stable housing is as essential to America’s social safety net as are Social Security, Medicaid and Medicare. Housing stability is central to improving life outcomes and economic mobility for low-income Americans. However, only one in five low-income households that are eligible to receive housing assistance can be served by existing programs due to limited funding. The pandemic has reinforced that rental assistance, such as the Housing Choice Voucher (HCV) program, is critical to ensuring housing stability and managing sudden losses in income. Just as Social Security, Medicare and Medicaid are structured to be available to all who are eligible, rental assistance must be too. Expansion of the voucher program offers a proven and effective approach to scale universal housing assistance to address housing instability and prevent homelessness in America.

Housing Choice Vouchers are a proven source of permanent housing stability. They are highly effective at providing long-term financial stability to formerly homeless populations and others experiencing housing instability. A recent HUD study found that offering families a permanent housing voucher resulted in greater housing and family stability compared to short-term interventions. Furthermore, a recent study from Columbia University found that expanding housing vouchers to all eligible households could help reduce poverty by 9.3 million people as well as reduce racial disparities in poverty. Vouchers are also frequently paired with supportive services to offer comprehensive assistance to individuals with complex mental and physical health conditions. Public housing authorities are uniquely positioned to aid low-income families in their challenges to regain employment and support children’s virtual learning because of their partnerships with nonprofit and government service providers that focus on education, health, and employment. Harvard’s Joint Center for Housing Studies recently reported on the critical role that service coordinators in publicly funded housing have played in providing food and supplies, assisting with technology, and combatting resident anxiety and loneliness. Housing Choice Vouchers are a proven and effective rental assistance delivery system to scale universal housing assistance because they can be quickly distributed through the existing network of 2,200 state and local housing agencies that administer vouchers in urban, suburban, and rural areas. Housing authorities are trusted experts and partners in their local rental markets, have been administering the voucher program for nearly 50 years and are accountable to local and federal oversight and operate with significant public input. With the proper funding, housing authorities have the capacity for a rapid expansion. Housing vouchers power local communities. Landlords, many of whom operate as a small business, understand that the voucher program is a guaranteed, reliable income source and provides the benefit of long-term stability. PHAs have been using the additional funding and regulatory relief provided by the Coronavirus Aid, Relief, and Economic Security (CARES) Act to expedite administrative processes most often cited by landlords as reasons for preferring unassisted tenants. With this funding, PHAs have also been able to offer incentives and support to increase landlord participation in the HCV program. We must strive to be a nation that believes that all people deserve the security that comes from having a home. Housing Choice Vouchers are the path to achieving this vision." |

|

||||||

|

|||||||

|

|

||

|

About the Council of Large Public Housing Authorities

About CLPHA’s Housing Is Initiative |

||

The Department of Housing and Urban Development today issued additional information about HUD’s contingency plan so that PHAs administering the HCV program may access their HUD-held Housing Assistance Payment Reserves (HHR) under certain circumstances due the lapse in appropriations.

According to the letter, HAP renewal funds and Administrative Fees are scheduled to be paid on time for February, but HUD recognizes that the funds may not cover the monthly HAP needs as a result of additional leasing or costs.

HUD will allow access to HHR funds in situations where the failure to act “would result in an imminent threat to the safety of human life or the protection of property.”

PHAs may request HAP reserves from HUD under the following circumstances:

- To protect families that are imminent risk of termination of assistance; and/or

- PHAs that were eligible to receive a payment for January 2019 and did not receive it (e.g. first time RAD payments for a project) and need reserves to ensure that the property owner(s) receive(s) a HAP payment to continue assistance and protect the residents at the property.

Read the letter for instructions to request an additional payment covered by the HHR.

For more information on the shutdown’s impact on public and affordable housing, join today’s national conference call at 4:00 pm ET for insights from CLPHA and other housing industry experts. Click here to register.

As the partial government shutdown continues and creates more uncertainty for public housing authorities, CLPHA is collecting information on the impacts and effects of the government shutdown on housing authorities and residents.

We are particularly interested in examples regarding landlord willingness to accept new vouchers from HCV participants, and PHA decisions around issuing new vouchers.

We will be sharing your feedback with our media contacts and coalition partners (please let us know if you do not want your PHA’s name identified).

Please send any information to Emily Warren at [email protected] as soon as possible.

CHCDF National Call to Learn About the Impacts of the Government Shutdown

CLPHA, as a member of the steering committee of the Campaign for Housing and Community Development Funding, will be participating in a national conference call on January 15 at 4:00 PM ET to provide updates on the latest information and guidance on how advocates can engage lawmakers to help end the shutdown.

In response to a January 5 Washington Post article focused on new research about where voucher holders live, CLPHA Executive Director Sunia Zaterman submitted a Letter to the Editor to emphasize examples of PHAs’ innovative housing mobility strategies. Although edited significantly for length, the version published in print and online describes landlord recruitment and retention efforts, and calls for additional local flexibilities and sufficient federal funding.

Today, CLPHA Executive Director Sunia Zaterman was quoted in Affordable Housing Finance discussing how the shutdown threatens the stability of low-income households. Though HUD has prepared payments for housing vouchers and the public housing operating subsidy through February, Zaterman notes that the “existential threat” for voucher holders looms given the uncertainty of when the shutdown will end. If housing authorities cannot utilize HUD funding after February, there is a risk that that they will not be able to pay landlords and that landlords will subsequently begin to evict voucher-holding tenants.

Zaterman added that as HUD funding remains suspended due to the shutdown, local housing authorities are growing increasingly concerned about how they will maintain properties, make repairs, and pay employees.

CLPHA will continue our advocacy in support of PHAs and will provide members with additional news about the shutdown as we learn it.

From KBPS San Diego:

"The San Diego Housing Commission's Board of Commissioners unanimously approved a new 210-bed homeless shelter program for women and children on Feb. 14.

The city will pay for the beds, but the housing commission will contract with Catholic Charities, Diocese of San Diego to operate the shelter — Rachel's Promise Center for Women and Children.

"With this new shelter, we're expanding our capacity to get more people off the street and connected to care," Mayor Todd Gloria said. "This builds on the work we've already done over the past four years to more than double shelter options and help nearly 5,000 people move into housing."

According to city documents, at full capacity, Rachel's Promise will consist of 109 beds for single women and 101 beds for families with children.

"We're seeing more women and girls among the people our homelessness programs are serving," said SDHC President and CEO Lisa Jones. "This new shelter program will help to address that growing need in a setting that allows for more privacy for families, focuses on the unique needs of women and girls, and provides the services necessary to assist them with moving on to longer- term or permanent homes."

Read KPBS San Diego's article "Housing Commission approves expanded Rachel's Promise homeless shelter."

From the Columbus Metropolitan Housing Authority's press release:

The Columbus Metropolitan Housing Authority (CMHA) Board of Commissioners announced today a major investment strategy that will bolster the agency’s ability to address Central Ohio’s “critical need” for more affordable housing.

The board has approved issuing up to $80 million in bonds that allow CMHA to invest:

- $13 million to acquire Demorest Townhomes, a 48-unit multifamily housing complex at 4157 River Bridge Circle in Grove City, as well as purchasing 11 acres of vacant land on the site to build an additional 104 units of future housing.

- $13 million to acquire and renovate a soon-to-be vacant two-story building at 3400 Morse Crossing in Columbus, which is earmarked as the new headquarters for CMHA’s Housing Choice Voucher (HCV) department. This move is pivotal as CMHA brings the HCV program in-house beginning March 3, 2025, reinforcing its commitment to enhance operational efficiency and service quality for Franklin County residents.

- $12 million to refinance and fund upgrades to a CMHA-owned 88-unit multifamily apartment community known as Canal’s Edge, 5303 Amalfi Drive in Canal Winchester, the southeastern Columbus suburb.

- $4 million to acquire a vacant, two-story office building at 195 N. Grant St. in downtown Columbus that CMHA plans to use for future redevelopment.

- An additional $10 million in bonds for the new construction of a 100-unit multifamily housing development in Reynoldsburg, known as Heights on Main. This decision now represents $35 million in CMHA bonds for the project, with the new $10 million in bonds supplementing the $25 million that was initially approved by the CMHA board in July 2024.

- The total amount for these combined investments is subject to change slightly as CMHA reviews pending cost estimates on necessary property improvements and building renovations.

In addition, the CMHA board has approved utilizing approximately $42.5 million in Project-Based Vouchers (PBVs) that will preserve affordable rental rates at three nonprofit-operated apartment communities in Columbus through 2040.

From Home Forward's press release:

Home Forward has acquired the Cesar Apartments, located near SE Hawthorne Blvd. and Cesar Chavez Blvd, to convert to Permanent Supportive Housing (PSH) for individuals exiting chronic homelessness. Purchasing the two-year-old building, which can be converted into supportive housing with minimal changes to the structure and layout, was part of an innovative strategy to capitalize on favorable market conditions to acquire market-rate buildings for affordable housing—a quick and cost-effective approach to bring more affordable housing on-line.

The Cesar offers 47 units ranging from studios to two-bedroom apartments. Built in 2022, the modern design, transit-accessible location, and community amenities make it an ideal site to support Multnomah County’s most vulnerable residents. With minimal structural changes required, the property will quickly transition into housing that fosters stability and dignity.

“Addressing our region’s affordable housing crisis requires a diverse set of tools and strategies. By leveraging new opportunities in the real estate market to supplement our existing efforts, and working across jurisdictions, we can rapidly expand the supply of permanent supportive housing at a fraction of the cost, maximizing public investment and delivering immediate solutions for those in need,” said Ivory Mathews, Chief Executive Officer of Home Forward. “This acquisition exemplifies the power of collaborative governance and bold, equitable action in addressing homelessness.”

The acquisition and conversion of the Cesar is possible thanks to $9 million from the Portland Housing Bureau (PHB), including $6.7 million in Metro Affordable Housing Bond funds designated for PSH pilot projects, and $2.3 million from Multnomah County, as well as Regional Long Term Rent Assistance and Supportive Housing Services funds from the Joint Office of Homeless Services to support wrap-around services for all Cesar residents.

“Last year, PHB began exploring whether we could bring much needed Permanent Supportive Housing online faster and at a lower cost than we usually achieve with new development,” said PHB Director Helmi A. Hisserich, “So we were very excited when Home Forward, Metro, and Multnomah County stepped up as partners on the Cesar Apartments acquisition. We look forward to announcing more acquisitions in the new year.”

The project aligns with the Portland Housing Bureau’s Local Implementation Strategy for Metro Bond funds, which aims to advance racial equity while producing 300 units of Permanent Supportive Housing, as well as 737 units with two or more bedrooms for families, and 605 units for households earning less than 30% of the area median income (or less than $28,320 a year for a family of two in 2024). The Cesar advances all three of these goals, which PHB is now exceeding across the board.

“This is a smart project to bring more affordable housing online and I’m proud of the creative approach used to increase our supply of supportive housing,” said Multnomah County Chair Jessica Vega Pederson. “With housing supply at crisis levels, this will create 47 residences specifically for people experiencing chronic homelessness with the support our neighbors need to stay housed long-term. This is aligned with our Homelessness Response System’s focus on tangible solutions to our region’s chronically low inventory of available housing.”

The building is nearly half vacant and remaining residents will have the option to continue living at the Cesar or receive relocation assistance from Home Forward. New residents will begin moving in this June through referrals from Coordinated Access. The Cesar will feature on-site services tailored to residents’ needs, including behavioral health resources, tenancy education, and eviction prevention support. These critical services, provided through partnerships with the Joint Office of Homeless Services and local service providers, will ensure long-term housing stability for residents.

“Changes in the housing market have made it possible to create affordable homes at a lower cost to taxpayers with the purchase of pre-existing buildings,” said Metro Councilor Duncan Hwang. “It’s great to see Portland using this opportunity to increase supportive housing for our region’s most vulnerable population.”

Home Forward will continue to work with the Joint Office of Homeless Services to select a service provider that aligns with its equity-driven mission. Together, they aim to create a supportive housing model that uplifts individuals while addressing systemic inequities in access to stable housing.

“Ending unsheltered homelessness is going to take innovative ideas and bold leadership. Home Forward’s acquisition of the Cesar Apartments and PHB’s work to bring more Permanent Supportive Housing to Portland is just that,” said Donnie Oliveira, Deputy City Administrator for Community and Economic Development. “The City will continue this work to address our housing crisis and bring critical resources to our most vulnerable populations, and we are proud of our partnerships with Home Forward, Multnomah County, Metro, and others to get it done.”

The Houston Housing Authority has named Jamie Bryant its new President & CEO.

Bryant brings nearly 25 years of experience in real estate development, organizational management, public-private partnerships and nonprofit governance to HHA. His career highlights include leading transformative projects throughout Houston that balance innovative development with community impact.

As CEO, Bryant guides HHA in advancing its mission to provide quality, affordable housing options and promote education and economic self-sufficiency.

Before joining HHA, Bryant served as the co-CEO of Parkway. Prior to Parkway, he was president and chief operating officer at Midway. During his tenure, he worked on transformative mixed-use projects such as the redevelopment of the Town & Country Mall site into CityCentre. This and other projects contributed to billions of dollars invested into Houston in mixed-use developments, leveraging partnerships with governmental and civic organizations to benefit all stakeholders.

Bryant has served on the boards of directors for nonprofit organizations at the forefront of affordable housing in Greater Houston, including Avenue and the Fifth Ward Redevelopment Authority. He has also served on advisory boards for the University of Houston, Cadence Bank and the management committee for Urban Land Institute Houston. His board service demonstrates an ongoing commitment to advancing affordable housing, infrastructure improvements and community development initiatives that benefit the region.

Outside his role as CEO, Bryant is an educator. He has shared his expertise by teaching graduate real estate and finance courses at the University of Houston’s Bauer School of Business and speaking on topics such as leadership and organizational culture. Bryant and his family also dedicate personal time to non-profit, educational and faith-based organizations they support in their community.

Bryant earned a Bachelor of Science in Management, Finance from Tulane University and a Master of Economics and Real Estate from Texas A&M University.

CLPHA welcomes Jamie Bryant to our membership!

From the Benton Institute for Broadband & Society:

The Cuyahoga Metropolitan Housing Authority (CMHA) owns and operates affordable housing locations for qualifying low-income families and individuals in the Cleveland, Ohio, metro area. CMHA was the first chartered public housing authority in the United States, and it has a mission “to create safe, quality, affordable housing opportunities and improve the quality of life for the communities [we] serve.” The organization houses more than 55,000 low-income residents living in Cuyahoga County. One part of fulfilling that mission happens through the CMHA digital inclusion programs, which provides digital navigation services to residents in several key areas: affordable internet connection options, computing devices, tech support, and digital literacy classes. CMHA is a ConnectHomeUSA (CHUSA) community, receiving funding from the U.S. Department of Housing and Urban Development (HUD) to support digital inclusion programs and services.

The information technology (IT) division at CMHA runs its digital inclusion programs and services, which start with ensuring that residents in every location have options for free or affordable internet access. CMHA makes bulk service agreements with ISPs like Spectrum and assists residents interested in subscribing. By making bulk agreements with ISPs, CMHA caps the monthly cost for any service at $20 and requires ISPs to provide a minimum download speed of 200 Mbps and a minimum upload speed of 20 Mbps. CMHA recognizes that internet service and the ability to use it to complete regular life tasks are not luxuries but necessities. For example, each year, residents are required to recertify their income to maintain their eligibility for affordable housing—a process that will soon be 100 percent online, so CMHA digital navigators assist residents who need help recertifying.

...

Partnerships with other organizations in the community are paramount to the CMHA Digital Inclusion Program’s success. For example, the Olivet Housing and Community Development Corporation leads many digital literacy courses at CMHA locations. By partnering with community organizations like Olivet, CMHA is able to simultaneously support more residents and support partners with overlapping missions to close the digital divide. Most courses take place over an eight-week period, and residents who successfully complete a course receive a device. Additional partner organizations provide training to digital navigators and staff, and others are internet service providers serving residents with low-cost home internet plans. The CMHA Digital Inclusion Program is also periodically able to distribute refurbished desktop and laptop computers that would otherwise be recycled to residents.