CLPHA supports the nation’s largest and most innovative housing authorities by advocating for the resources and policies they need to solve local housing challenges and create communities of opportunity. We frequently champion our members' issues, needs, and successes on the Hill, at HUD, and in the media. In these arenas CLPHA also advocates for legislation and policies that help our members, and the public and affordable housing industry as a whole, strengthen neighborhoods and improve lives.

Click below for links to congressional testimonies, statements for the record, action alerts, comments to HUD and other federal agencies, and the latest information about CLPHA's multi-pronged housing advocacy.

Yesterday, the Office of Management and Budget (OMB) published a memorandum, which directs all federal agencies to pause all “federal financial assistance” (FFA) "to the extent permissible under applicable law." The temporary pause in funding will become effective on January 28, 2025 at 5:00 p.m. ET.

According to news reports, OMB distributed a questionnaire to federal agencies this morning asking them to provide information about whether their programs are in compliance with the Trump administration’s policy goals and executive orders. OMB’s questions for agencies concern undocumented immigration, environmental and climate justice programs, and diversity, equity, and inclusion policies and initiatives.

Capitol Hill staff, HUD staff, advocacy organizations, and other stakeholders appear uncertain about how the memo will be enforced, which programs are affected, and how long this pause will last.

Housing authorities are reporting that they are locked out of eLOCCS before the 5:00 p.m. deadline. We are investigating if this is a systemwide issue or if it is deliberate. We anticipate that PHAs will be locked out of eLOCCS after 5:00 p.m. ET today.

If you are locked out of eLOCCS, contact your member of Congress and Senators to make sure they are aware of the problem. Congress needs to hear how this pause is disrupting daily operations of public housing authorities.

When speaking with Members of Congress highlight the following points:

- Highlight how the pause is affecting your daily operations, especially if you are locked out of eLOCCS. Your Member of Congress/Senator may not understand what exactly what eLOCCS is. Explain that it is the system that allows public housing authorities to access federal funds for key housing programs such as vouchers and public housing.

- Highlight the breakdown of residents you serve who will be impacted by the pause: the number of seniors, children, veterans who could lose access to federal housing assistance at your PHA.

- Highlight the economic impact that your public housing authority has in your community, such as jobs created, number of private landlords affected, and if the pause would halt any development deals.

Please share the outcome of your conversations with Members of Congress with CLPHA Legislative Manager Cynthia Cuestas at [email protected].

|

Negotiations to finalize Fiscal Year 2025 (FY25) spending bills are currently ongoing in Congress. Facing a December 20 deadline to fund the government and avoid a shutdown, House Speaker Mike Johnson (R-LA) has publicly called for passing another continuing resolution (CR) lasting into early next year. CLPHA is concerned about the recent Housing Choice Voucher Program funding shortfall. The amount to cover the funding shortfall and voucher renewals exceeds $600 million. We must urge Congress to fully fund Housing Choice Voucher Renewals and provide additional amounts in any final FY25 Appropriations bill to offset the FY24 shortfall to maintain assistance for families at risk of losing their homes. ACTION: We are asking CLPHA members to send a letter to representatives in both the House and Senate asking them to support fully funding Housing Choice Vouchers in the final FY25 Appropriations bill. We drafted a sample letter for your use as a guide:

We recommend that you email the letter to your Members of Congress. |

Bill Restores Increase in 9 Percent Housing Authority Credit and Lowers Bond-financing Threshold for 4 Percent Housing Credit

Yesterday, July 29, Senate Majority Leader Chuck Schumer (D-NY) filed a cloture motion that enables H.R. 7024, the Tax Relief for American Families and Workers Act, to be brought to the Senate floor for a vote this Thursday, August 1.

The legislation passed the House of Representatives earlier this year on a large bipartisan vote of 357 to 70, however it has been stalled in the Senate for months due to opposition to parts of the bill that are not related to affordable housing, specifically the Child Tax Credit provisions.

This is probably the last and only time this bill has a chance of passing Congress and being signed by the President during this 118th Congress.

ACTION:

Please reach out to your Senators today to remind them how important this legislation is for affordable housing and urge them to vote for passage of the legislation.

The bill would:

- Restore the 12.5 percent increase in 9 percent Housing Credit authority the program suffered after a temporary increase expired in 2021. The bill's cap increase would apply to calendar years 2023, 2024, and 2025.

- Lower the bond-financing threshold for 4 percent Housing Credit developments financed with bonds that have an issue date prior to 2026.

For further information, contact Gerard Holder, CLPHA Legislative Director, at [email protected].

|

In February, the House of Representatives passed H.R. 7024, The Tax Relief for American Families and Workers Act of 2024, which received overwhelming bipartisan support. The bill includes two Low-Income Housing Tax Credit (LIHTC) provisions that would restore the 12.5% allocation increase for 2023 to 2025 and lower the 50% bond financing threshold to 30% for Private Activity Bond allocations made in 2024 to 2025. The bill also includes a $33 billion expansion of the Child Tax Credit (CTC) for the next three years. While the CTC in this bill is not as generous as the 2021 provision included in the American Rescue Plan, this expansion and continuation of the program acknowledges that the benefits provided by the CTC should be continued. The legislation faced various roadblocks in the Senate, including opposition from Senate Finance Committee Chair Mike Crapo (R-ID) due to the CTC provisions included in the bill. However, ongoing discussions are still happening to possibly move the bill forward for a floor vote. We strongly ask that CLPHA members continue to reach out to your Senators and urge them to pass H.R. 7024, the Tax Relief for American Families and Workers Act of 2024.

|

|

ACTION: When asking your Senator to support the Tax Relief for American Families and Workers Act of 2024, mention the importance of, and share your support for, the two LIHTC and CTC related provisions in the bill and ask that the housing provisions are retained in the Senate: LIHTC provisions:

CTC provisions:

The ACTION Campaign, where CLPHA is a Steering Committee member, has prepared background and advocacy materials about the Tax Relief for American Families and Workers Act of 2024. |

|

|

|

On February 1, 2024, the House of Representatives passed H.R. 7024, The Tax Relief for American Families and Workers Act of 2024 which includes two Low-Income Housing Tax Credit (LIHTC) provisions that were also included in the Affordable Housing Credit Improvement Act (H.R. 3238/S. 1557). According to Novogradac, the provisions which would restore the 12.5 percent allocation for 2023-2025 and lower the 50 percent bond financial threshold to 30 percent for 2024-2025, would finance more than 200,000 additional affordable homes. The bill still needs to be considered by the Senate, which faces several challenges, including a busy legislative agenda for February. Members of the Senate have also floated the idea of scheduling a potential markup of the bill which could potentially amend the legislation and further delay any vote to bring the bill on the Senate floor. The Tax Relief for American Families and Workers Act may also be the last opportunity for Congress to pass any tax related provisions until 2025. The ACTION Campaign, where CLPHA is a Steering Committee member, has prepared background and advocacy materials about the Tax Relief for American Families and Workers Act of 2024.

|

|

ACTION:

For questions or additional information, contact Gerard Holder, CLPHA Legislative Director at [email protected]. or Cynthia Cuestas, CLPHA Legislative Assistant, at [email protected]. |

|

Congress Needs To Increase Public And Affordable Housing Funding |

|

Background: The federal government is currently funded under a continuing resolution (CR) that expires December 16 this year. If the government does not take additional action it runs out of money and has to shut down. Given the uncertainty of what will happen in the appropriations process during the next Congress beginning in January, it is critical that the current Congress finish the work already begun and pass a full year FY23 appropriations bill. CLPHA is particularly concerned with the Transportation, Housing and Urban Development, and Related Agencies (THUD) proposed legislation currently in final negotiations between the House and Senate. CLPHA and industry partners recently sent a letter and revised joint appropriations request to the leadership of the House and Senate appropriations committees asking for specific funding levels and authorizing language be included in the final THUD appropriations bill. Among our requests, we ask Congress to increase funding for the HUD defined shortfalls in the public housing operating fund program to $345 million to accommodate all eligible housing authorities. We ask the committees to accept the Senate-proposed level of $364 million in set-aside funding for tenant protection vouchers (TPVs) since HUD recently indicated that the current demand for TPVs has exceeded its initial projections for FY23 and they again anticipate not being able to fund replacement TPVs for vacant units in calendar year 2023 without additional funding. We also ask that HUD be directed to determine the impact of recent changes to the calculation of FY23 Fair Market Rents (FMRs), because of the recent extension of regulatory waivers increasing payment standards up to 120 percent of the FMR in local housing markets affecting the need for additional housing assistance payments (HAP) set-aside funding.

|

|

ACTION: CLPHA is calling on members to: 1) Ask your Members of Congress to support the recommendations included in the public housing industry joint funding request and joint industry letter. 2) Ask your Members of Congress to support the THUD funding bill. 3) Ask your Members of Congress to support final passage of a full-year FY23 appropriations bill.

For questions or additional information, contact Gerard Holder, CLPHA Legislative Director at [email protected]. |

|

BACKGROUND: CLPHA and our industry partners today sent a letter (and attachments Exhibit 1 and Exhibit 2) to House and Senate Appropriations Committee members asking to include legislative language that prevents HUD from implementing unilateral changes to the ACC in the forthcoming FY23 appropriations bill. This joint industry request was made by CLPHA, the MTW Collaborative, the National Association of Housing and Redevelopment Officials (NAHRO) and the Public Housing Authorities Directors Association (PHADA). CLPHA and our industry partners remain concerned that HUD’s continued attempts to revise the ACC will circumvent the Administrative Procedure Act (APA), unilaterally change the contractual relationship between HUD and public housing agencies (PHAs), and strip PHAs of their ability to challenge HUD’s breach of contract actions, which PHAs have recently successfully litigated. Without the inclusion of the legislative language mentioned in our letter, we are concerned that HUD’s ability to make problematic changes to the ACC has been renewed. This week the full House passed six appropriations bills including its version of the FY23 HUD bill. Since the Senate has not yet taken action on their bill version, we hope to have the ACC language included in the Senate bill, and we are seeking eventual conference committee action between the House and Senate to include the ACC language and committee report language. |

|

ACTION: We are asking housing authorities to sign and send a similar letter asking their representatives in both the House and Senate to reinstate the legislative language regarding the ACC in the General Provisions section of the FY23 HUD appropriations legislation. We’ve drafted a sample letter as a guide for you.

|

|

|

If you have any questions, contact Gerard Holder, CLPHA Legislative Director, at [email protected]. |

KEEP HOUSING FUNDING IN BUILD BACK BETTER

Negotiations and progress on enacting Build Back Better legislation have reached an impasse, and Senate opponents to the bill, as written and passed by the House, have indicated they prefer a slimmed down, reduced funding bill.

Consequently, CLPHA has been made aware that funding for housing programs is, once again, at serious risk of being removed from the Build Back Better Act.

The housing investments in this economic recovery package is expected to help make transformational improvements in the lives of low-income and vulnerable Americans and in our communities.

Last week, CLPHA and other national organizations advocating for public housing and related programs sent a letter to the House and Senate leaders asking that housing be retained in Build Back Better or any related reconciliation vehicle.

The housing investments in this economic recovery package are expected to help make transformational improvements in the lives of low-income and vulnerable Americans and in our communities.

|

ACTION:

|

|

|

|

||

|

We are asking housing authorities and housing organizations to sign on to a similar letter to Congressional leaders urging them to retain funding for the Public Housing Capital Fund and Housing Choice Vouchers in the Build Back Better legislation.

Sign-ons are Due by February 4!

|

||

|

CLPHA has been made aware that funding for housing is at serious risk of being removed from the Build Back Better Act under consideration in the budget reconciliation negotiations currently underway in Congress and the White House.

The House Financial Services Committee on September 14 provided $327 billion in funding for affordable housing and community development programs to be included in the President’s Build Back Better Act. The housing investments in this economic recovery package is expected to help make transformational improvements in the lives of low-income and vulnerable Americans and in our communities.

The negotiations are on a fast track and taking place at the highest levels between the House and Senate leadership, key members of Congress, and the White House. We understand Congress and the White House have not heard from housing stakeholders on the importance of keeping housing in the legislation.

We have been told that the next 48 hours are critical to keeping housing in the legislation.

Since housing is very much on the chopping block, we encourage CLPHA members to:

Reach out to your representatives in the House and Senate and ask them to contact their leadership and express support for retaining the housing provisions in the Build Back Better Act.

We cannot overstate how important it is for you to contact your Congresspersons and Senators and have them communicate with their Leadership and the White House that

HOUSING MUST BE INCLUDED IN THE BUILD BACK BETTER ACT!

|

|

|

|

|

||

|

|

||

|

Important Talking Points Include:

|

|

|

|

|

||

|

|

|

|

||

|

|

1 Public Housing Stimulus Funding: A Report on the Economic Impact of Recovery Act Capital Improvements, Commissioned by PHADA, CLPHA and NAHRO with funding from the Housing Authority Insurance (HAI) Group, 2011.

|

|

|

Today, CLPHA released a new brief outlining the solutions needed to mitigate the sudden and unexpected termination of the Emergency Housing Voucher (EHV) program, which will be devastating for families, private property owners, and their communities. 60,000 households will face homelessness and thousands of property owners will risk losing rental income if Congress does not act to secure additional funding, enact statutory solutions, and provide regulatory flexibility to redress the negative effects of the EHV program’s termination. The EHV program, established in May 2021 through the American Rescue Plan, represents one of the most significant and successful federal investments in addressing homelessness in recent history. EHVs have proven to be a lifeline for some of the nation’s most vulnerable populations, including young children, seniors, and people with disabilities, by providing immediate access to stable housing and supportive services. The program’s success has been driven by flexible funding that enables public housing authorities (PHA) to offer landlord incentives, pay security and utility deposits, and support tenants with housing search assistance. With $5 billion in funding, the program created 70,000 vouchers to assist individuals and families who are homeless, at risk of homelessness, fleeing domestic violence, or transitioning out of homelessness. CLPHA members administer approximately 30,000 EHVs, accounting for nearly half of the total leased EHVs in the United States. Congress must act to protect 60,000 households from facing homelessness and thousands of property owners from experiencing lost income. Learn more about CLPHA's EHV advocacy on clpha.org. |

|

|

|

In response to President Trump’s Administration fiscal year 2026 (FY26) budget proposal released this month, CLPHA, the Public Housing Authorities Directors Association, the National Association of Housing and Redevelopment Officials, the Local Housing Administrators Coalition, and the MTW Collaborative released our joint FY26 funding recommendations for the U.S. Department of Housing and Urban Development (HUD). Among other requests, we urge HUD to fully fund the Public Housing Fund, including $5 billion for the Capital Fund, $5.72 billion for the Operating Fund, and $580 million to address the Operating Fund shortfall. Furthermore, we requested $300 million for the Choice Neighborhoods Initiative, $37.487 billion for Housing Choice Voucher (HCV) Renewals, $3.622 billion for HCV Administrative Fees, and $500 million for Tenant Protection Vouchers. |

|

|

|

|

Winning Team Awarded $15,000 and Will Present Their Design at CLPHA’s Summer Meeting, Hosted by Atlanta Housing

UC Berkeley Team Gold Earns Second Place; University of Kansas and Yale University Teams Named Runners-up

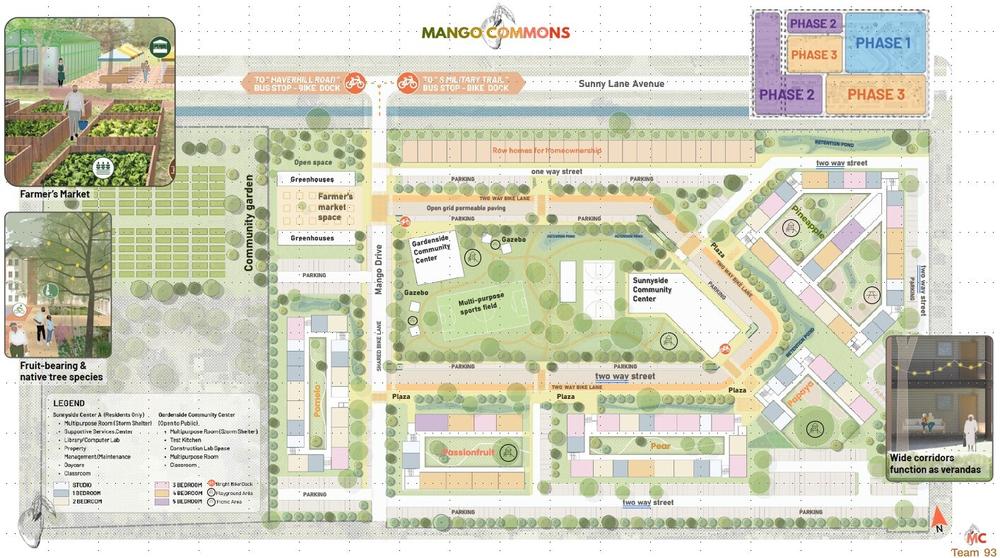

WASHINGTON, D.C. (May 22, 2025) – The Council of Large Public Housing Authorities (CLPHA) is pleased to announce that the University of California, Berkeley’s Team Blue has been named the winner of the 2025 Innovation in Affordable Housing Student Design and Planning Competition. The first-place team, comprised of Omeed Ansari, Yameen Arshad, Balaji Balaganesan, Harrison Haigood, and Chelsea Hall, will be awarded $15,000 and present their winning design at CLPHA’s Summer Meeting, hosted by Atlanta Housing, on June 13 in Atlanta, Georgia.

The 2025 competition partnered with the Palm Beach County Housing Authority (PBCHA) in Palm Beach County, Florida. CLPHA stepped in to host the competition after it was terminated by the U.S. Department of Housing and Urban Development.

"CLPHA congratulates UC Berkeley Team Blue on winning the 2025 Innovation in Affordable Housing Student Design and Planning Competition,” said CLPHA Executive Director Sunia Zaterman. “Their ‘Mango Commons’ design incorporated innovative, climate-resilient design, thoughtful integration of resident services and programs, and comprehensive financing solutions that brought PBCHA’s community to life. This first-place team and all participating university teams represent the best and brightest in the future of affordable housing development, design, and planning, and CLPHA is honored to celebrate their ingenuity and hard work.”

Each year, the Innovation in Affordable Housing competition invites graduate students enrolled in accredited educational institutions in the United States to form multi-disciplinary teams to respond to an existing affordable housing design and planning issue. The competition requires teams composed of graduate students in architecture, planning and policy, finance, and other areas to address social, economic, environmental, design, financial, and construction issues in addition to an affordable housing design challenge.

The theme for the 2025 competition is “designing for disasters.” The graduate student teams were challenged to address the lack of affordable housing in Palm Beach County due to a shortage of land for development, while also considering the property is subject to Florida weather related to heat, heavy rains resulting in flooding, hurricanes and high winds, as well as post-disaster safety concerns. The student teams were tasked with redeveloping an underutilized 13+ acre parcel of land owned by PBCHA that currently has a 134-unit public housing development and a maximum density of 350 units.

UC Berkeley Team Blue’s winning design, named Mango Commons, is rooted in disaster resilience, long-term sustainability, and community cohesion. The 350-unit, three-phased redevelopment plan for PBCHA is innovative and resident-driven. Mango Commons makes use of built and natural systems for climate resilience, underpinned by the site’s self-sustaining circular economy. In its design, the project boasts large outdoor verandas to build social resilience and hearken to Southern “front porch” culture. Mango Commons also leverages community gardens, tech education, and culinary programming to promote food security, self-sufficiency, and intergenerational activities for the entire community. Lastly, for its financing, it incorporates a unique option-to-buy program and a partnership with Habitat for Humanity to build homes for ownership.

|

“Competitions like this are so important for students to be able to address real-life situations and learn through doing,” said UC Berkeley Team Blue Faculty Advisor Lydia Tan. “UC Berkeley’s Team Blue this year was exemplary—the team dug deep into the local issues facing the Palm Beach County Housing Authority and the community, talking with a plethora of local stakeholders in an effort to truly understand the local ecosystem. The team’s ultimate proposal is realistically executable, would result in an amazing environment for current and future residents, and can act as a catalyst to bring the local community even closer together. Thanks to CLPHA and all of those who picked up the task of carrying out the competition so that all the students who competed could have their ideas shared with the public.” The University of California, Berkeley’s Team Gold earned second place in the competition and will be awarded $5,000. Runner-up teams from the University of Kansas and Yale University will be awarded $2,500 each. Eleven teams entered the competition from universities including Columbia University, University of Florida, University of Iowa, and University of Maryland College Park. On May 8, the finalist graduate student teams presented their final projects to a jury of practitioners. The jurors included:

The design competition is supported by sponsors from across the architecture, real estate, and finance sectors, including Bank of America, the Cooper Housing Institute, CSG Advisors, Enterprise, Merritt Community Capital Corporation, The Pacific Companies, Raymond James Affordable Housing Investments, Palm Beach County Housing Authority, Redstone Equity Partners, Related California, and US Bankcorp Impact Finance.

Media Contact: (916) 716-9088 |

|

###

About the Council of Large Public Housing Authorities About the Palm Beach County Housing Authority Located at 3333 Forest Hill Boulevard in West Palm Beach, Florida, PBCHA advocates for those who need housing and strives to provide Palm Beach County residents with affordable housing options, self-sufficiency programs, and leadership opportunities. The agency is committed to providing quality living environments through new and existing housing developments. To contact PBCHA, call 561-684-2160 or visit the website at pbchafl.org. |