CLPHA supports the nation’s largest and most innovative housing authorities by advocating for the resources and policies they need to solve local housing challenges and create communities of opportunity. We frequently champion our members' issues, needs, and successes on the Hill, at HUD, and in the media. In these arenas CLPHA also advocates for legislation and policies that help our members, and the public and affordable housing industry as a whole, strengthen neighborhoods and improve lives.

Click below for links to congressional testimonies, statements for the record, action alerts, comments to HUD and other federal agencies, and the latest information about CLPHA's multi-pronged housing advocacy.

- Reach out to your Member of Congress.

- Explain why the SAVE Act is important to your public housing authority, your residents and your community.

- Urge your member of Congress to support the SAVE Act when it is re-introduced in Congress.

|

Deadline: 5:00 PM ET Tomorrow, March 26

Urge your members of Congress to cosponsor H.R. 1904: The Broadband Justice Act of 2021. The COVID-19 pandemic has highlighted the growing digital divide and the deepening disparities among access to essential technology. These inequities especially impact lower income households and those living in federally assisted housing.

By updating the definitions used by HUD, the Department of Treasury, and USDA for utility allowance, The Broadband Justice Act of 2021 would bring affordable broadband to 8 million households residing in federally assisted housing throughout the nation. Bolstered through the creation of a new grant program to develop the required infrastructure and additional operating funds to mitigate increased costs, access to broadband as an allowed utility would be federally subsidized, in a similar way that gas, electricity, and water currently are. Congressman Bowman (D-NY), the bill sponsor, is organizing support for the letter and has set a Friday, March 26, 5:00 pm ET deadline for House members to sign on.

|

|

|

|

|

||

|

ACTION:

1) CLPHA is asking you to strongly encourage your Members of Congress to cosponsor H.R. 1904: The Broadband Justice Act of 2021.

2) Your Member of Congress should fill out this form to cosponsor the bill.

For additional information, please email Josh Shokoor, CLPHA Research & Policy Analyst, at [email protected].

|

|

|

|

|

||

|

Congressional Democrats are moving the next COVID-19 bill swiftly through Congress. CLPHA and other national public housing industry groups are asking our members to sign on to a joint industry letter to be sent to congressional leadership asking for additional emergency funding and longer-term preservation resources for public housing operating funding, housing vouchers, and infrastructure funding.

|

|

|

|

|

||

|

Sign-on for the letter is on a short deadline with

sign-on due by 12:00 p.m. ET Friday, February 12.

Therefore, CLPHA is calling on members to re-double efforts to ensure our funding requests are considered by Congress and included in the next economic stimulus package.

|

- Communicate with your Members of Congress and ask them to support including emergency funding and longer-term preservation resources for public housing, housing vouchers and infrastructure in the next COVID relief legislation.

- Ask your Members of Congress to urge the House and Senate Leadership to include emergency funding and longer-term preservation resources for public housing, housing vouchers and infrastructure in the next COVID relief legislation.

|

The Council of Large Public Housing Authorities has endorsed H.R. 4351, the Yes in My Backyard (YIMBY) Act. The YIMBY Act, originally co-sponsored by Representatives Denny Heck (D-WA) and Trey Hollingsworth (R-IN), is a bipartisan housing bill that seeks to encourage, while not mandating, localities to advance policies that eliminate discriminatory land use policies, exclusionary zoning and other artificial barriers to building affordable housing.

The YIMBY Act achieves these goals by requiring Community Development Block Grant (CDBG) recipients to report periodically on the extent to which they are removing discriminatory land use policies and implementing inclusive and affordable housing policies detailed by the bill.

The YIMBY Act passed the U.S. House of Representatives unopposed under suspension of the rules on March 2, 2020, and is now in the Senate awaiting consideration. CLPHA is working with Up for Growth Action, the lead advocacy organization generating support for the bill, and is encouraging our members to sign-on as an endorser of the bill.

There is a narrow window of opportunity to advance the YIMBY bill to passage after recess in September, and broad geographic, organizational, and industry support can help convince Senate leadership the bill should be considered for a vote.

|

|

|

|

|

||

|

|

ACTION: To add your organization to the endorser’s list, please send an email to: For questions or additional information, contact CLPHA Legislative Director Gerard Holder at [email protected].

|

|

Emergency rental assistance is in jeopardy in the latest stimulus package in the Senate. Early indication is that housing assistance and direct rental assistance will not be a part of the Senate legislative package. The Senate is debating the stimulus right now. Renters are facing a devastating cliff with CARES Act protections expiring at the end of this month. Public housing authorities’ voices are critical to the Senate debate.

The Senate returned this week, resuming legislative activity for the next two weeks until their next recess begins August 7. This is the last opportunity to pass emergency economic relief and stimulus legislation in 2020 before Congress hits the campaign trail for the November elections.

The recent House-passed HR 6800, the “Health and Economic Recovery Omnibus Emergency Solutions Act” or the “HEROES Act,” is a critically needed legislative package designed to provide economic relief to states, cities, local jurisdictions, medical front-line workers, first responders, unemployed persons, consumers, students, renters, homeowners, housing providers, and more.

The HEROES Act provides over $114 billion in funding for housing and community development programs. It includes $100 billion in emergency rental assistance, $4 billion for Tenant-Based Rental Assistance, $2 billion for the Public Housing Operating Fund, and $750 million for Project Based Rental Assistance.

For this reason, CLPHA is urging members to make your voices heard to ensure emergency rental assistance is included in the next economic relief and stimulus package. CLPHA is calling for the $100 billion under the Emergency Solutions Grant Program (ESG) to be made flexible to allow different funding portals, such as emergency single-use housing vouchers, or for other rental assistance platforms be able to allocate the funds.

|

|

|

|

|

||

|

|

CLPHA strongly encourages members to:

Without your active engagement with your Senators, providing additional housing assistance to housing authorities will be jeopardized.

Senators must hear from you to know this is important!

For questions or additional information, contact CLPHA Legislative Director Gerard Holder at [email protected].

|

However, the joint letter is not enough!

It is critical that you follow up with your representatives and stress the need for providing additional resources to housing authorities as you work to deal with this devastating health and economic crisis.

Without your active engagement with your Members of Congress, policymakers on Capitol Hill will give lower priority to providing additional resources to housing authorities.

CLPHA is calling on members to step up efforts to ensure our funding requests are considered by Congress and included in the next economic stimulus package.

CLPHA strongly urges members to:

Over the past weekend of March 21, we asked CLPHA members to sign onto a letter to be sent to congressional leadership asking for emergency funding and longer-term preservation resources for public housing and housing vouchers in a COVID-19 stimulus package.

Sign on deadline for the letter has been extended. Negotiations for a third supplemental economic stimulus legislative package continue. The House Democrats under the leadership of Speaker Pelosi recently unveiled their separate stimulus package, and the possibility of a fourth economic stimulus legislative package is also being discussed.

Therefore, CLPHA is calling on members to re-double efforts to ensure our funding and regulatory relief requests are considered by Congress.

Specifically, CLPHA asks members to:

- Sign-on to the letter sent this past weekend, if you have not already done so

- Send a letter to your Members of Congress and ask them to support including emergency funding and longer-term preservation resources for public housing and housing vouchers in the next COVID-19 economic stimulus legislation. (see attached form letter)

- Ask your Members of Congress to urge the House and Senate Leadership to include emergency funding and longer-term preservation resources for public housing and housing vouchers in the next COVID-19 economic stimulus legislation.

BACKGROUND

HOUSE:

The Democratic proposal spearheaded by House Speaker Nancy Pelosi (D-CA) unveiled on March 23, HR 6379, the “Take Responsibility for Workers and Families Act” introduced by Appropriations Committee Chairwoman Nita Lowey (D-NY), includes housing-related provisions in two main sections, Division A—Third Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020, and Division I—Financial Services, Title I—Protecting Consumers, Renters, Homeowners and People Experiencing Homelessness. Division I wholly taken from HR 6321, “Financial Protections and Assistance for America’s Consumers, States, Businesses, and Vulnerable Populations Act” was also introduced on March 23 by House Financial Services Chairwoman Maxine Waters (D-CA). Highlights from the Speaker’s package include:

DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT (HUD) – $158.827 billion

Management and Administration – $20 million to support activities by the Administrative Support Offices and Program Offices to prevent, prepare for, and respond to coronavirus. Funding would also support program administration and oversight for the $158.8 billion in emergency assistance provided to state, local, and tribal governments and housing authorities through this Act.

Tenant-Based Rental Assistance – $1.5 billion to allow public housing agencies (PHAs) to respond to coronavirus and the ability to keep over 2.2 million families stably housed even when facing a loss of income. Allows PHAs the flexibility necessary for the safe and effective administration of these funds while maintaining fair housing, nondiscrimination, labor standards, and environmental protections.

Public Housing Operating Fund – $720 million for PHAs to carry out coronavirus response for the operation and management of almost 1 million public housing units. Allows PHAs the flexibility necessary for the safe and effective administration of these funds while maintaining fair housing, nondiscrimination, labor standards, and environmental protections.

Native American Programs – $350 million to address the needs of Indian tribes and tribally designated housing entities in preventing, responding to, and preparing for coronavirus. This includes $250 million in formula funding through the Native American Housing Block Grants program and $100 million in imminent threat grants through the Indian Community Development Block Grant program.

Housing Opportunities for Persons with AIDS – $130 million to maintain operations, rental assistance, supportive services, and other necessary actions to mitigate the impact of coronavirus on low-income persons with HIV/AIDS.

Community Development Block Grant – $15 billion for coronavirus response and to mitigate the impacts in our communities: up to $8 billion to be distributed by formula to current grantees, $5 billion awarded directly to States, based on public health needs and other factors, and the remainder to be awarded on a rolling basis via a formula that prioritizes the risk of transmission of coronavirus, number of coronavirus cases, and economic and housing market disruptions resulting from coronavirus. The legislation also waives the public services cap to allow communities to respond to the impacts of the pandemic.

Homeless Assistance Grants – $5 billion for Emergency Solutions Grants to address the impact of coronavirus among individuals and families who are homeless or at risk of homelessness and to support additional homeless assistance, prevention, and diversion activities to mitigate the impacts of the pandemic.

Emergency Rental Assistance – $100 billion to provide emergency assistance to help low-income renters at risk of homelessness avoid eviction due to the economic impact of the coronavirus pandemic.

Housing Assistance Fund – $35 billion for State housing finance agencies to provide housing or utility assistance to individuals and families to prevent foreclosure, eviction, mortgage delinquency, or loss of housing or critical utilities as a result of the coronavirus pandemic.

Assisted Housing Stability – A total of $1.1 billion for HUD multi-family housing programs to prevent, prepare for and respond to coronavirus and ensure the continuation of rental contracts and necessary support services, including:

- Project-Based Rental Assistance – $1 billion;

- Section 202 Housing for the Elderly – $75 million; and

- Section 811 Housing for Persons with Disabilities – $25 million.

Office of Fair Housing and Equal Opportunity – $7 million to address fair housing issues resulting from coronavirus. This includes $4 million for the Fair Housing Assistance Program and $3 million for the Fair Housing Initiatives Program.

DOT and HUD Oversight –

Inspectors General – $10 million total for the DOT and HUD Inspectors General to conduct audits and investigations to ensure transparency and efficiency within the agencies as they prevent, prepare for, and respond to coronavirus.

SENATE:

The CARES Act, the third supplemental economic stimulus legislative package offered by Senate Majority Leader Mitch McConnell, contains the following provisions for HUD:

DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT – $17.4 billion

Community Development Block Grant (CDBG) – $10 billion. CDBG is a flexible program that provides communities and states with funding to provide a wide range of resources to address COVID-19, such as services for senior citizens, the homeless, and public health services. Funding will be distributed using formula.

Homeless Assistance Grants – $4 billion. These funds will enable state and local governments to address coronavirus among the homeless population. These grants, in combination with additional waiver authority, will provide effective, targeted assistance to contain the spread of coronavirus among homeless individuals. These grants will also provide state and local governments with homelessness prevention funding for individuals and families who would otherwise become homeless due to coronavirus.

Tenant-Based Rental Assistance – $1.25 billion. These funds will preserve Section 8 voucher rental assistance for seniors, the disabled, and low-income working families, who will experience loss of income from the coronavirus.

Public Housing Operating Fund – $685 million. These funds will provide Public Housing Agencies with additional operating assistance to make up for reduced tenant rent payments as well as to help contain the spread of coronavirus in public housing properties.

Native American Programs – $300 million. These funds will be used to prevent homelessness due to lost income from the coronavirus, as well as to contain the spread of coronavirus on tribal lands. These programs provide flexibility to local tribal governments and Tribally-Designated Housing Entities to respond to local conditions and needs.

Housing Opportunities for Person with Aids (HOPWA) – $65 million. HOPWA is dedicated to the housing needs of people living with HIV/AIDS by giving grants to local communities, states, and nonprofit organizations for projects that benefit low-income persons living with HIV/AIDS and their families.

Project-Based Rental Assistance – $1 billion. This additional funding will make up for reduced tenant payments as a result of coronavirus. Preserving this critical housing assistance will prevent low-income families and individuals from being at risk of homelessness.

Section 202 Housing for the Elderly – $50 million. These funds will maintain housing stability and services for low-income seniors. Seniors are particularly at risk from the coronavirus.

Section 811 Housing for Persons with Disabilities – $15 million. This additional funding will make up for reduced tenant payments as a result of coronavirus.

Fair Housing – $2.5 million for additional fair housing enforcement.

HUD Administrative Expenses – $50 million. These funds will ensure that HUD’s programs are able to continue serving low-income vulnerable populations, while also providing states and local governments with resources to contain and respond to the coronavirus.

HUD Inspector General – $5 million. Funding for the HUD Inspector General to provide oversight and ensure funds provided are used for lawful purposes.

CLPHA joined with industry colleagues NAHRO, PHADA, and the MTW Collaborative today to send a statement to House and Senate Committee leadership urging their support for the ACC contract language included in the Senate’s FY20 THUD Appropriations bill.

Because HUD’s proposed revisions to the ACC contain some provisions that are problematic and were not resolved during a joint industry meeting with PIH Assistant Secretary Hunter Kurtz and HUD staff, the four groups remain concerned that without the Senate appropriations language, HUD’s new ACC will not meet the standards set in the Housing Act of 1937 and the current ACC.

ACTION:

As members of the House and Senate Appropriations committee negotiate the final THUD appropriations bill, it is imperative that CLPHA members contact their Senators and Representatives and urge them to support the Senate’s language on the ACC.

If your Senators or Representatives are appropriators (see the list below) it is critical that CLPHA members contact them this week and ask them to support the Senate’s THUD Appropriations language on the ACC.

If you have questions about this action alert or the current status of the ACC, please contact CLPHA’s Legislative Director Gerard Holder at [email protected].

Members of the Appropriations Committees

HOUSE APPROPRIATIONS COMMITTEE

|

MAJORITY |

State |

Dist. |

MINORITY |

State |

Dist. |

|

|

Nita M. Lowey, Chairwoman |

NY |

17 |

Kay Granger, Ranking Member |

TX |

12 |

|

|

Marcy Kaptur |

OH |

9 |

Harold Rogers |

KY |

5 |

|

|

Peter J. Visclosky |

IN |

1 |

Robert Aderholt |

AL |

4 |

|

|

Jose E. Serrano |

NY |

15 |

Michael K. Simpson |

ID |

2 |

|

|

Rosa L. DeLauro |

CT |

3 |

John Carter |

TX |

31 |

|

|

David E. Price, THUD Chair |

NC |

4 |

Ken Calvert |

CA |

42 |

|

|

Lucille Roybal-Allard |

CA |

40 |

Tom Cole |

OK |

4 |

|

|

Sanford D. Bishop, Jr. |

GA |

2 |

Mario Diaz-Balart, THUD Ranking |

FL |

25 |

|

|

Barbara Lee |

CA |

13 |

Tom Graves |

GA |

14 |

|

|

Betty McCollum |

MN |

4 |

Steve Womack |

AR |

3 |

|

|

Tim Ryan |

OH |

13 |

Jeff Fortenberry |

NE |

1 |

|

|

C.A. Dutch Ruppersberger |

MD |

2 |

Charles Fleischmann |

TN |

3 |

|

|

Debbie Wasserman Schultz |

FL |

23 |

Jaime Herrera Beutler |

WA |

3 |

|

|

Henry Cuellar |

TX |

28 |

David Joyce |

OH |

14 |

|

|

Chellie Pingree |

ME |

1 |

Andy Harris |

MD |

1 |

|

|

Mike Quigley, THUD Vice Chair |

IL |

5 |

Martha Roby |

AL |

2 |

|

|

Derek Kilmer |

WA |

6 |

Mark Amodei |

NV |

2 |

|

|

Matt Cartwright |

PA |

8 |

Chris Stewart |

UT |

2 |

|

|

Grace Meng |

NY |

6 |

Steven Palazzo |

MS |

4 |

|

|

Mark Pocan |

WI |

2 |

Dan Newhouse |

WA |

4 |

|

|

Katherine Clark |

MA |

5 |

John Moolenaar |

MI |

4 |

|

|

Pete Aguilar |

CA |

31 |

John Rutherford |

FL |

4 |

|

|

Lois Frankel |

FL |

21 |

Will Hurd |

TX |

23 |

|

|

Cheri Bustos |

IL |

17 |

||||

|

Bonnie Watson Coleman |

NJ |

12 |

||||

|

Brenda Lawrence |

MI |

14 |

||||

|

Norma Torres |

CA |

35 |

||||

|

Charlie Crist |

FL |

13 |

||||

|

Ann Kirkpatrick |

AZ |

2 |

||||

|

Ed Case |

HI |

1 |

SENATE APPROPRIATIONS COMMITTEE

|

MAJORITY |

State |

MINORITY |

State |

|

|

Richard C. Shelby |

AL |

Patrick J. Leahy, Vice Chair |

VT |

|

|

Mitch McConnell |

KY |

Patty Murray |

WA |

|

|

Lamar Alexander |

TN |

Dianne Feinstein |

CA |

|

|

Susan Collins, THUD Chair |

ME |

Richard J. Durbin |

IL |

|

|

Lisa Murkowski |

AK |

Jack Reed, Thud Ranking |

RI |

|

|

Lindsay Graham |

SC |

Jon Tester |

MT |

|

|

Roy Blunt |

MO |

Tom Udall |

NM |

|

|

Jerry Moran |

KS |

Jeanne Shaheen |

NH |

|

|

John Hoeven |

ND |

Jeff Merkley |

OR |

|

|

John Boozman |

AR |

Chris Coons |

DE |

|

|

Shelley Moore Capito |

WV |

Brian Schatz |

HI |

|

|

John Kennedy |

LA |

Tammy Baldwin |

WI |

|

|

Cindy Hyde-Smith |

MI |

Christopher Murphy |

CT |

|

|

Steve Daines |

MT |

Joe Manchin |

WV |

|

|

Marco Rubio |

FL |

Chris Van Hollen |

MD |

|

|

James Lankford |

OK |

|||

The House of Representatives may vote as soon as next week on bipartisan legislation to permanently authorize HUD’s Community Development Block Grant–Disaster Recovery (CDBG-DR) program.

The bill – the “Reforming Disaster Recovery Act” – includes key reforms to the CDBG-DR program to help ensure that federal disaster recovery efforts reach all impacted households.

The bill was introduced by Representatives Al Green (D-TX) and Ann Wagner (R-MO) and passed out of the House Financial Services Committee this summer with unanimous support.

CDBG-DR provides states and communities with flexible, long-term recovery resources needed to rebuild affordable housing and infrastructure after a disaster. By formally authorizing the program, the bill would help ensure the process is administered consistently and that dollars can flow more quickly to communities in need. In addition, the bill includes important measures to ensure that scarce resources are targeted to families and communities with the greatest needs.

For more information on these important measures please see the fact sheet from our colleagues at the Disaster Housing Recovery Coalition.

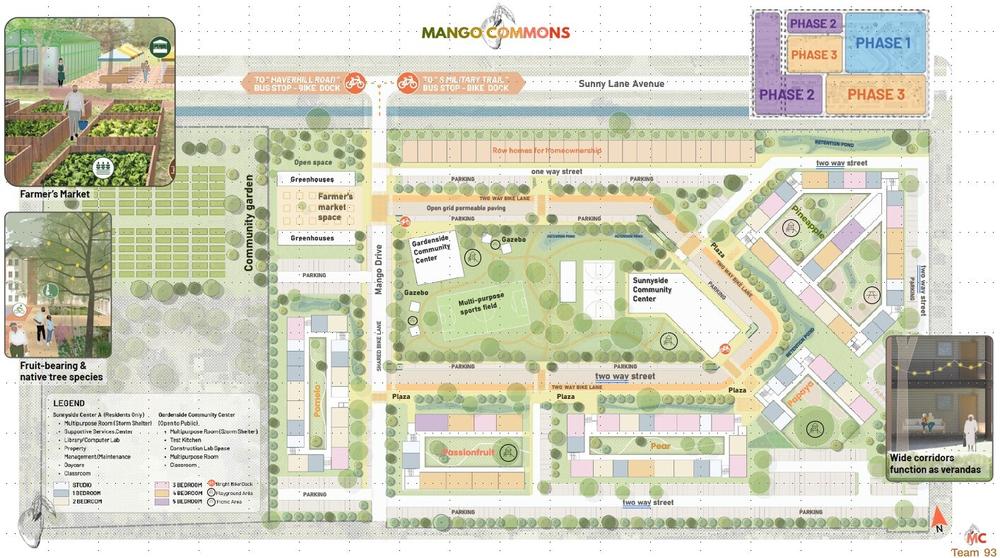

Winning Team Awarded $15,000 and Will Present Their Design at CLPHA’s Summer Meeting, Hosted by Atlanta Housing

UC Berkeley Team Gold Earns Second Place; University of Kansas and Yale University Teams Named Runners-up

WASHINGTON, D.C. (May 22, 2025) – The Council of Large Public Housing Authorities (CLPHA) is pleased to announce that the University of California, Berkeley’s Team Blue has been named the winner of the 2025 Innovation in Affordable Housing Student Design and Planning Competition. The first-place team, comprised of Omeed Ansari, Yameen Arshad, Balaji Balaganesan, Harrison Haigood, and Chelsea Hall, will be awarded $15,000 and present their winning design at CLPHA’s Summer Meeting, hosted by Atlanta Housing, on June 13 in Atlanta, Georgia.

The 2025 competition partnered with the Palm Beach County Housing Authority (PBCHA) in Palm Beach County, Florida. CLPHA stepped in to host the competition after it was terminated by the U.S. Department of Housing and Urban Development.

"CLPHA congratulates UC Berkeley Team Blue on winning the 2025 Innovation in Affordable Housing Student Design and Planning Competition,” said CLPHA Executive Director Sunia Zaterman. “Their ‘Mango Commons’ design incorporated innovative, climate-resilient design, thoughtful integration of resident services and programs, and comprehensive financing solutions that brought PBCHA’s community to life. This first-place team and all participating university teams represent the best and brightest in the future of affordable housing development, design, and planning, and CLPHA is honored to celebrate their ingenuity and hard work.”

Each year, the Innovation in Affordable Housing competition invites graduate students enrolled in accredited educational institutions in the United States to form multi-disciplinary teams to respond to an existing affordable housing design and planning issue. The competition requires teams composed of graduate students in architecture, planning and policy, finance, and other areas to address social, economic, environmental, design, financial, and construction issues in addition to an affordable housing design challenge.

The theme for the 2025 competition is “designing for disasters.” The graduate student teams were challenged to address the lack of affordable housing in Palm Beach County due to a shortage of land for development, while also considering the property is subject to Florida weather related to heat, heavy rains resulting in flooding, hurricanes and high winds, as well as post-disaster safety concerns. The student teams were tasked with redeveloping an underutilized 13+ acre parcel of land owned by PBCHA that currently has a 134-unit public housing development and a maximum density of 350 units.

UC Berkeley Team Blue’s winning design, named Mango Commons, is rooted in disaster resilience, long-term sustainability, and community cohesion. The 350-unit, three-phased redevelopment plan for PBCHA is innovative and resident-driven. Mango Commons makes use of built and natural systems for climate resilience, underpinned by the site’s self-sustaining circular economy. In its design, the project boasts large outdoor verandas to build social resilience and hearken to Southern “front porch” culture. Mango Commons also leverages community gardens, tech education, and culinary programming to promote food security, self-sufficiency, and intergenerational activities for the entire community. Lastly, for its financing, it incorporates a unique option-to-buy program and a partnership with Habitat for Humanity to build homes for ownership.

|

“Competitions like this are so important for students to be able to address real-life situations and learn through doing,” said UC Berkeley Team Blue Faculty Advisor Lydia Tan. “UC Berkeley’s Team Blue this year was exemplary—the team dug deep into the local issues facing the Palm Beach County Housing Authority and the community, talking with a plethora of local stakeholders in an effort to truly understand the local ecosystem. The team’s ultimate proposal is realistically executable, would result in an amazing environment for current and future residents, and can act as a catalyst to bring the local community even closer together. Thanks to CLPHA and all of those who picked up the task of carrying out the competition so that all the students who competed could have their ideas shared with the public.” The University of California, Berkeley’s Team Gold earned second place in the competition and will be awarded $5,000. Runner-up teams from the University of Kansas and Yale University will be awarded $2,500 each. Eleven teams entered the competition from universities including Columbia University, University of Florida, University of Iowa, and University of Maryland College Park. On May 8, the finalist graduate student teams presented their final projects to a jury of practitioners. The jurors included:

The design competition is supported by sponsors from across the architecture, real estate, and finance sectors, including Bank of America, the Cooper Housing Institute, CSG Advisors, Enterprise, Merritt Community Capital Corporation, The Pacific Companies, Raymond James Affordable Housing Investments, Palm Beach County Housing Authority, Redstone Equity Partners, Related California, and US Bankcorp Impact Finance.

Media Contact: (916) 716-9088 |

|

###

About the Council of Large Public Housing Authorities About the Palm Beach County Housing Authority Located at 3333 Forest Hill Boulevard in West Palm Beach, Florida, PBCHA advocates for those who need housing and strives to provide Palm Beach County residents with affordable housing options, self-sufficiency programs, and leadership opportunities. The agency is committed to providing quality living environments through new and existing housing developments. To contact PBCHA, call 561-684-2160 or visit the website at pbchafl.org. |

CLPHA Begins Nationwide Search for Next Executive Director

|

WASHINGTON, D.C. (May 19, 2025) -- The Council of Large Public Housing Authorities (CLPHA) today announced that CLPHA Executive Director Sunia Zaterman plans to retire at the end of 2025. Zaterman has led CLPHA, a national non-profit membership organization that works to preserve and improve public and affordable housing through advocacy, research, policy analysis, and public education, for over thirty years. The CLPHA Board of Directors has engaged Sally M. Sterling Executive Search to lead its nationwide search for a new executive director.

“For over three decades Sunia has been one of the most influential leaders in the housing industry,” said Jeffery K. Patterson, CLPHA Board President and Cuyahoga Metropolitan Housing Authority CEO. “CLPHA, under Sunia’s leadership, has helped shape the evolution, innovation, and development of public and affordable housing. Our housing industry will forever be grateful for her advocacy, dedication, and commitment, as well as the many significant contributions that Sunia has made which have been so beneficial to communities across the nation. CLPHA’s Board of Directors deeply thanks her for her stewardship, vision, and friendship, and wish her all the best in her next chapter.” Under Zaterman’s leadership CLPHA has been at the vanguard of the public and affordable housing industry’s most successful advancements, pushing for the tools and resources that PHAs need to evolve with national trends and respond to local challenges. Throughout her tenure CLPHA has been a staunch advocate for considering affordable housing for low-income households a key aspect of the social safety net on par with Medicaid, Medicare, and Social Security. At the beginning of Zaterman’s tenure, she established and directed the Housing Research Foundation (HRF), a CLPHA affiliate, to serve as the information and technical assistance clearinghouse for the nascent HOPE VI program under a cooperation agreement with HUD. HRF was instrumental in bringing new tools and ideas to PHAs on public/private finance, urban design, community building, resident service supports, and peer learning. “Sunia will leave CLPHA with a legacy of compassion, leadership, and transformative impact upon her retirement,” said La Shelle Dozier, CLPHA Board Vice President and Sacramento Housing & Redevelopment Agency Executive Director. “Throughout her significant career at CLPHA and many years in the public and affordable housing industry, Sunia has ensured that improving the life outcomes of low-income individuals remains at the heart of CLPHA’s mission. Countless individuals served by PHAs have enjoyed increased housing stability, economic security, and access to critical services thanks to the initiatives and innovations that CLPHA has championed under Sunia’s leadership. Our industry will miss her greatly.” Under her leadership CLPHA was instrumental in the creation and subsequent expansions of the Moving to Work (MTW) demonstration, a HUD program that allows PHAs greater flexibility to develop local solutions for local housing challenges. MTW PHAs have pioneered and scaled successful programs and greater efficiencies that improve lives and more effectively address the nation’s housing crisis. Many initiatives stemming from MTW PHAs have been adopted into law and regulations. CLPHA supported the creation of the MTW Collaborative, a non-profit membership organization that advocates on behalf of current and future MTW agencies. CLPHA continues the partnership with the Collaborative through a management agreement. “During her extraordinary tenure as CLPHA’s executive director Sunia has played a critical role in improving national housing policy and strengthening the affordable housing industry,” said Joshua Meehan, MTW Collaborative Board President and Keene Housing Executive Director. “Her leadership at CLPHA has consistently supported public housing authorities in doing better work for the people we serve. Her focus on amplifying the role public housing authorities can play in improving educational, economic, and health outcomes for residents and voucher holders is especially noteworthy and appreciated, and I know the entire industry is grateful to her for her hard work and dedication. I wish her the very best in her well-deserved retirement.” Recognizing the need for PHAs to expand cross-sector collaboration to better serve residents and create platforms for opportunity, under Zaterman’s leadership CLPHA developed Housing Is, an initiative to foster collaboration across the health, education, and housing sectors through shared goals, focused resources, and coordinated efforts. At its core, Housing Is helps build a future where systems work together to improve life outcomes. Housing Is has convened 11 national summits with a wide array of cross-sector partners. CLPHA continues its partnership with Housing Is under a management agreement. “Sunia has been a champion of housers and affordable housing for decades,” said George Guy, National Association of Housing and Redevelopment Officials (NAHRO) President and CEO/Executive Director of the Fort Wayne Housing Authority. “Sunia has helped cultivate collaboration and innovative ideas that have provided useful resources and tools to assist agencies in serving their communities. She is a true servant leader. I am grateful for her hard work, her leadership, and her tireless advocacy on behalf of public housing agencies and the residents they serve." During Zaterman’s tenure CLPHA was also instrumental in the creation of the Rental Assistance Demonstration (RAD), a HUD program that preserves and improves affordable housing by allowing PHAs to leverage public-private partnerships to convert public housing units to long-term, project-based Section 8 rental assistance. CLPHA convened the RAD Collaborative, an initiative to build a community of practice and support to recapitalize the public housing portfolio, and offered stakeholders national and regional conferences, webinars, and policy analysis. Building on the successes of RAD to leverage private investment and responding to the need for expanded recapitalization tools and resources, CLPHA spearheads, under Zaterman’s leadership, the 10 Year Roadmap for Housing Sustainability. The Roadmap convenes a broad-based coalition of experts in housing, finance, development, and cross-sector approaches to develop and advance a 10-year reinvestment plan that establishes a sustainable, affordable, and service-enriched housing platform for residents to achieve their life goals. "Congratulations to Sunia on her upcoming retirement,” said Mark Gillett, Public Housing Authorities Directors Association (PHADA) Immediate Past President and Oklahoma City Housing Authority Executive Director. “Her years of work with CLPHA reflect a deep commitment to housing policy and public service. Sunia has played a consistent role in shaping national conversations around affordable housing. As she steps into retirement, her presence in the field throughout her long career is much appreciated. We wish her the very best in the next chapter." In addition to her leadership of CLPHA, Zaterman currently serves on the board of the Emerald Cities Collaborative. She has also served on the Harvard Joint Center on Housing Studies' America's Rental Housing 2024 Advisory Group, Convergence Collaborative on Social Determinants of Health, American Rescue Plan Evaluation National Expert Panel, and Johns Hopkins HOPES Policy Advisory Board. She began her career in housing as a New York State governor’s fellow at the New York State Housing Finance Agency. She also served as the judiciary committee clerk in the Texas State Legislature. Zaterman served as the executive director of the Travis County, TX Housing Authority, and the director of research and development Alexandria, VA Redevelopment and Housing Authority. She was nominated for the Hanley Award for Vision and Leadership in Sustainable Housing. Zaterman holds a master’s degree in urban planning from Princeton University and a bachelor’s degree in history from Barnard College. In advance of Zaterman’s retirement, CLPHA has begun a nationwide search for its next executive director through Sally M. Sterling Executive Search. To inquire about the position, email [email protected].

|

|

### About the Council of Large Public Housing Authorities |

|

This morning, CLPHA, the Public Housing Authorities Directors Association (PHADA), the National Association of Housing Redevelopment Officials (NAHRO), the National Alliance to End Homelessness (NAEH), the Center on Budget and Policy Priorities (CBPP), the National Low Income Housing Coalition (NLIHC), the Moving to Work (MTW) Collaborative, and the National Housing Law Project (NHLP) sent a letter to Congress concerning the future of the Emergency Housing Voucher (EHV) Program. The letter details the disastrous effects that 60,000 households who rely on the EHV program and public housing authorities who administer the vouchers could face if funding for the program lapses. The housing industry and advocacy groups urged Congress to provide adequate funding and flexibilities in the final FY26 Transportation, Housing and Urban Development, and Related Agencies (THUD) Appropriations bill to ensure that current households served by the EHV program do not lose the critical assistance they rely on and risk homelessness. |

|

|

Throughout her tenure Zaterman has remained a steady and thoughtful steward of the needs of CLPHA members, who today number more than 85 of the largest and most innovative public housing authorities (PHAs) across the country. CLPHA’s members collectively own and manage nearly 40 percent of the nation’s public housing stock, administer more than a quarter of the Housing Choice Voucher program, and provide a wide array of other rental assistance. Above all, CLPHA under Zaterman’s leadership has centered the needs of low-income families that PHAs serve when charting the organization’s goals and priorities.

Throughout her tenure Zaterman has remained a steady and thoughtful steward of the needs of CLPHA members, who today number more than 85 of the largest and most innovative public housing authorities (PHAs) across the country. CLPHA’s members collectively own and manage nearly 40 percent of the nation’s public housing stock, administer more than a quarter of the Housing Choice Voucher program, and provide a wide array of other rental assistance. Above all, CLPHA under Zaterman’s leadership has centered the needs of low-income families that PHAs serve when charting the organization’s goals and priorities.