The HCV program supports the lowest-income families who struggle to secure safe, affordable housing in the private market. At least 75 percent of new voucher holders must have incomes that are below 30% of their area’s median income. In 2018, the average annual household income among tenants in the program is approximately $14,700.

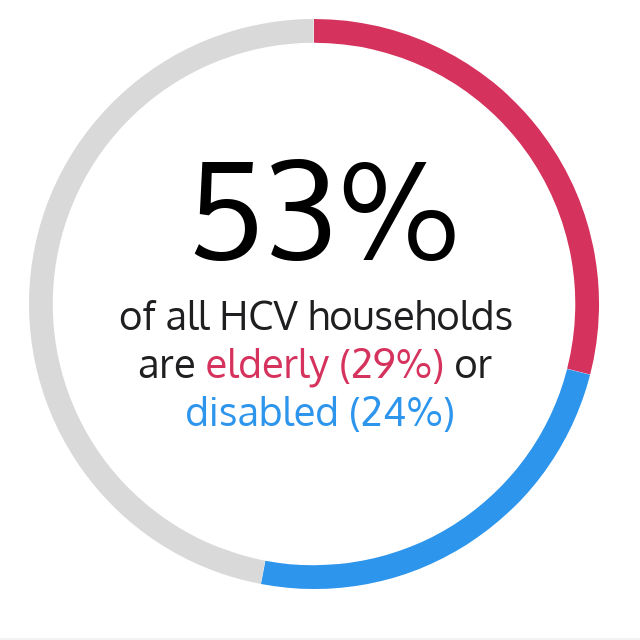

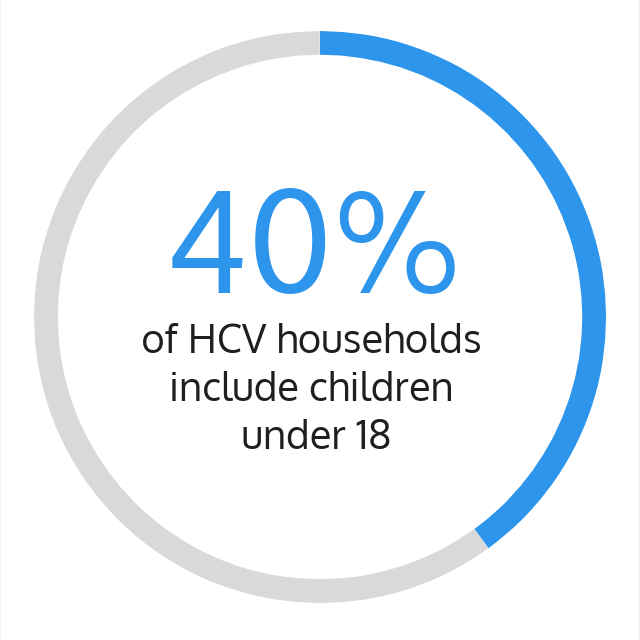

While targeting the most economically disadvantaged households, the HCV program also serves the most vulnerable. In 2018, 53 percent of HCV households were elderly (29 percent) or disabled (24 percent). Forty percent of HCV households included children under the age of 18. Of those non-disabled, non-elderly HCV households, 75 percent were working, worked recently, or likely were subject to work requirements.

To:

Members of the U.S. Senate Committee on Banking, Housing, and Urban Affairs

Members of the U.S. House of Representatives Committee on Financial Services

Members of the U.S. Senate Committee on Appropriations

Members of the U.S. House of Representatives Committee on Appropriations

From:

Sunia Zaterman, Executive Director, Council of Large Public Housing Authorities

Gerard Holder, Legislative Director, Council of Large Public Housing Authorities

RE: The Time is Now for Housing Choice Voucher Expansion

Critical Moment

We must stand up and take action in the face of our triple national catastrophe of the COVID-19 pandemic, the ensuing economic calamity, and most importantly, our long history of systemic racial and economic inequalities. Now, more than ever, we should ensure secure, stable and safe housing for low income households and for those who are threatened by homelessness because they cannot pay rent or find a place to live. The pandemic has exacerbated the crisis in housing availability and affordability to levels never seen before. The Census Bureau's most recent survey highlights the staggering impact of COVID-19 with nearly 25 percent of all adults reporting housing insecurity, which is defined as either missing their rent or mortgage payment last month and/or expressing little or no confidence in their ability to afford their next housing payment.

In less than three months since the novel coronavirus reached the United States, the economic conditions have deteriorated rapidly. It is disproportionately affecting the same low-income families who are the most likely to already be struggling with housing affordability. This is causing significantly higher unemployment rates, and the depths of its effects on job security and health status among America’s most vulnerable families is very uncertain.

Congress's response through the CARES Act was swift and significant by appropriating $17 billion to U.S. Department of Housing and Urban Development programs, with $1.25 billion of those funds appropriated for “Tenant-Based Rental Assistance” that provides additional funds for public housing agencies for Housing Choice Vouchers.

However, the need is so great, it remains unmet. The recently introduced HEROES Act provides substantial housing-related resources. As the HEROES Act moves through the legislative process, CLPHA is calling for a significant additional expansion of the Housing Choice Voucher program as one of the most effective federal housing assistance delivery systems during the pandemic, and beyond.

Housing Voucher Program Expansion

The Housing Choice Voucher (HCV) program currently serves 2.2 million households nationally. It is a critical component of the social safety net for low-income families. Paying the difference between a household’s total rent and 30 percent of their total income, the HCV program provides long-term housing stability, a measure of stability essential for promoting family stability and opportunities for economic self-sufficiency and mobility.

As a non-entitlement program, the HCV program currently serves approximately 1 out of every 4 households eligible to receive a voucher. According to analysis from the Terner Center for Housing Innovation, 16.5 million renter households have at least one worker employed in an industry that is likely to be affected by efforts to control the COVID-19 pandemic. An estimated 7 million of those households were already struggling with high housing costs prior to the beginning of the pandemic. With the Congressional Budget Office forecasting national unemployment to reach 16 percent by the third quarter of 2020, these households face significant and long-term challenges to job security, making it impossible for many to pay market-rate rent rental costs. The number of unassisted households eligible for the HCV program will increase, and these households will need long-term assistance to remain stably housed amid long-term impacts to many of the industries in which they are employed.

To respond to the needs of low-income renter households experiencing high rent burdens and employment loss, the best solution is to expand the HCV program to support them with long-term rental assistance.

Why Housing Choice Voucher Expansion is the Most Effective Policy?

-

Public Housing Authorities (PHAs) have the capacity for expansion. Nationally, over 2,000 PHAs administer vouchers. These agencies have the infrastructure in place that is needed to support a substantial increase in voucher availability. Using statutory and regulatory flexibilities granted by the CARES Act, PHAs are working to expedite the timeline between issuing a voucher and the household moving into a unit.

-

Vouchers are much more cost effective than other shorter-term rental assistance. A 2016 randomized study commissioned by HUD to examine various housing interventions for families involved with the child welfare system found that average monthly per-family program costs were $1,172 for vouchers compared to $4,819 for emergency shelter and $2,706 for transitional housing. Long-term assistance is the most cost-effective approach for ensuring long-term stability and avoiding episodes of homelessness or housing insecurity.

-

The unique effects of the COVID-19 pandemic require a unique solution. During the Great Recession, the Homeless Prevention and Rapid-Rehousing Program (HPRP) provided short-term rental assistance and was largely successful in preventing homelessness and reducing periods of homelessness. The COVID-19 pandemic is a disaster on an entirely different scale; a deeper, more long-lasting subsidy is needed to help families financially recover from the pandemic while remaining stably housed.

-

Rental providers may be more attracted to the voucher program as a stable income source, leading to more families being able to make use of their voucher. Especially in high-cost areas, PHAs have historically experienced challenges in recruiting landlords to participate in the voucher program. With many households having difficulty paying rent on time, landlords may view the voucher program more favorably as a guaranteed income source. PHAs can also use their CARES Act waiver authority to expedite administrative processes most often cited by landlords as reasons for preferring unassisted tenants.

-

PHAs have extensive experience with service provision and coordination. In addition to providing them with safe, affordable housing, PHAs are also in a position to provide or coordinate services that households are likely to need during recovery from the pandemic. Employment services through programs such as the Family Self-Sufficiency Program and Jobs Plus can help families who have experienced employment loss. PHAs also coordinate with schools, food programs, and health care providers to support families in a holistic way that unassisted households may have more difficulty accessing.

-

The voucher program can be expanded in several ways. Congress could appropriate an additional set of vouchers that are permanently awarded to PHAs, or PHAs could receive a set of vouchers that sunset after a certain time period. For example, vouchers could sunset after use by one or more households or after a specified number of years. Any of these methods would allow for families to receive longer-term rent assistance and could be modeled closely on current voucher program administration processes and rules.

The Time is Now for Housing Choice Voucher Expansion

The short- and long-term effects of the COVID-19 pandemic require a response proportional to the growing magnitude of this crisis. Through an expansion of the HCV program that PHAs have the capacity to manage, vouchers can provide cost effective assistance, bring landlords into the program, and provide cross-sector services to address the needs of low-income families through several possible expansion scenarios. An expansion of the voucher program is the best solution to address the growing affordability crisis among households affected by the pandemic.

About the Council of Large Public Housing Authorities

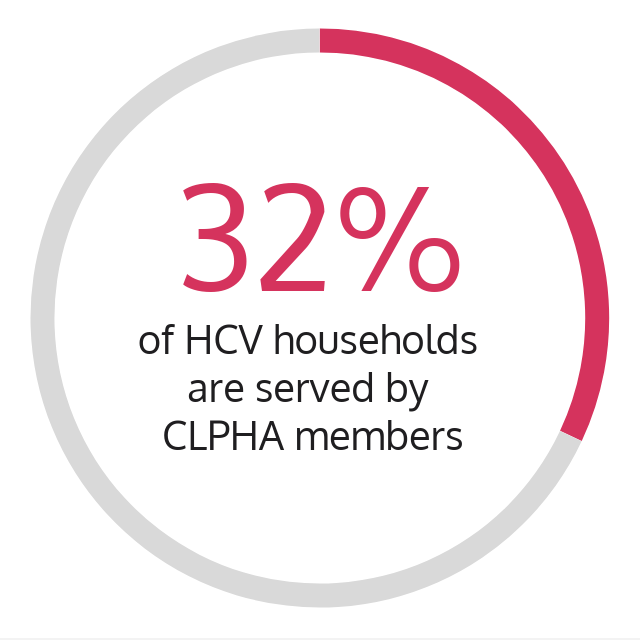

The Council of Large Public Housing Authorities is a national non-profit organization that works to preserve and improve public and affordable housing through advocacy, research, policy analysis and public education. CLPHA’s 70 members represent virtually every major metropolitan area in the country. Together they manage 40 percent of the nation’s public housing program; administer more than a quarter of the Housing Choice Voucher program; and operate a wide array of other housing programs. Learn more at clpha.org and on Twitter @CLPHA and follow @housing_is for news on CLPHA’s work to better intersect the housing field and other areas of critical importance such as health and education.

On May 12, House Democrats, led by Speaker Nancy Pelosi, offered the next supplemental funding and authorizing legislation for economic relief due to the COVID-19 coronavirus pandemic crisis. HR 6800, the “Health and Economic Recovery Omnibus Emergency Solutions Act” or the “HEROES Act” is a massive (1,815 pages) legislative package estimated at almost three trillion dollars to provide relief to states, cities, local jurisdictions, medical front-line workers, first responders, unemployed, consumers, students, housing providers, and more. The bill may be headed toa floor vote before the full House as early as tomorrow, Friday, May 15, or by early next week. Outlook for the bill is uncertain, at best, in the Republican-controlled Senate.

Thanks to advocacy by CLPHA members with their congressional representatives, House Democrats listened to CLPHA’s concerns by including several legislative proposals to further benefit public and assisted housing communities during this pandemic.

Tenant-Based Rental Assistance

The bill appropriates additional funds for Tenant-Based Rental Assistance (TBRA). It is worth noting that Sec. 110206, under Division K (COVID–19 HERO ACT) only authorizes $3 billion for TBRA, yet $4 billion is appropriated. TBRA would receive $4 billion under the same authority and conditions as the additional appropriations for fiscal year 2020 as in the CARES Act “except that any amounts provided for administrative expenses and other expenses of public housing agencies for their section 8 programs, including Mainstream vouchers, under this heading in the CARES Act (Public Law 116–136) and under this heading in this Act shall also be available for Housing Assistance Payments under section 8(o) of the United States Housing Act of 1937.”

Funding and legislative authority under TBRA further provides that, “amounts made available under this heading in this Act and under the same heading in title XII of division B of the CARES Act may be used to cover or reimburse allowable costs incurred to prevent, prepare for, and respond to coronavirus regardless of the date on which such costs were incurred.” With this language the bill makes it clear that flexibility and fungibility from administrative fees to HAP is authorized, despite the previous HUD notice disallowing it, and that all costs incurred by housing authorities due to coronavirus are covered notwithstanding the date the costs were incurred.

From the $4 billion for TBRA, the bill would appropriate $2.5 billion for adjustments in the calendar year 2020 Section 8 renewal funding allocations for housing authorities experiencing a significant increase in voucher per-unit costs due to extraordinary circumstances, and $500 million for administrative fees.

Also under TBRA, the bill appropriates $1 billion for an Emergency Rental Assistance Voucher Program, with new single-issue incremental vouchers targeted to individuals and families who are homeless, at risk of homelessness, fleeing, or attempting to flee, domestic violence, dating violence, sexual assault, or stalking. HUD is required to allocate the funding to housing authorities within 60 days of enactment according to a formula that considers housing authorities’ ability to use vouchers promptly and the need of geographical areas based on factors such as risk of transmission of coronavirus, high numbers or rates of sheltered and unsheltered homelessness, and economic and housing market conditions.

Public Housing Operating Fund

CLPHA members and industry partners were also successful in convincing policymakers to appropriate $2 billion more to the Public Housing Operating Fund. The funds would be provided under the same authority and conditions as the additional appropriations for fiscal year 2020 as in the CARES Act, “Provided, That amounts made available under this heading in this Act and under the same heading in title XII of division B of the CARES Act may be used to cover or reimburse allowable costs incurred to prevent, prepare for, and respond to coronavirus regardless of the date on which such costs were incurred.”

Choice Neighborhood Initiative

Additionally, at CLPHA urging, the bill would protect funding that was shortly due to expire under the Choice Neighborhood Initiative by extending funding through September 30, 2021.

Emergency Solutions Grants

The bill appropriates $100 billion for Emergency Rental Assistance “for grants under the Emergency Solutions Grants program to be used for providing short or medium-term assistance with rent and rent-related costs (including tenant-paid utility costs, utility- and rent arrears, fees charged for those arrears, and security and utility deposits,” and appropriates an additional $11.5 billion under current Homeless Assistance Grants for the Emergency Solutions Grants program.

Project-Based Rental Assistance

The bill appropriates $750 million additional for Project-Based Rental Assistance under the same authority and conditions as the additional appropriations for fiscal year 2020 as in the CARES Act.

General Provisions

Sec. 10906. Provides that funding under the heading for Project-Based Rental Assistance (along with Section 202 and 811 housing) in both the CARES Act and this act may be used to provide additional funds to maintain operations, for providing supportive services, and for taking other necessary actions to prevent, prepare for, and respond to coronavirus, including actions to self-isolate, quarantine, or to provide other coronavirus infection control services as recommended by the CDC, including providing relocation services for residents to provide lodging at hotels, motels, or other locations.

Other housing and community development programs receiving appropriated funding include:

- $5 billion in Community Development Block Grants

- $500 million in additional funding for Section 202 elderly housing properties, with $300 million for one-time grants for service coordinators

- $200 million for Section 811 properties for housing persons with disabilities

- $100 million for housing counseling assistance

- $14 million for Fair Housing Activities