The HCV program supports the lowest-income families who struggle to secure safe, affordable housing in the private market. At least 75 percent of new voucher holders must have incomes that are below 30% of their area’s median income. In 2018, the average annual household income among tenants in the program is approximately $14,700.

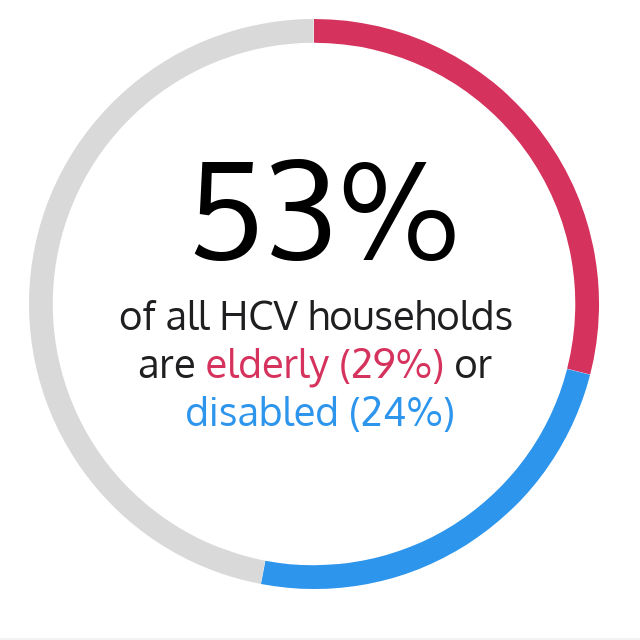

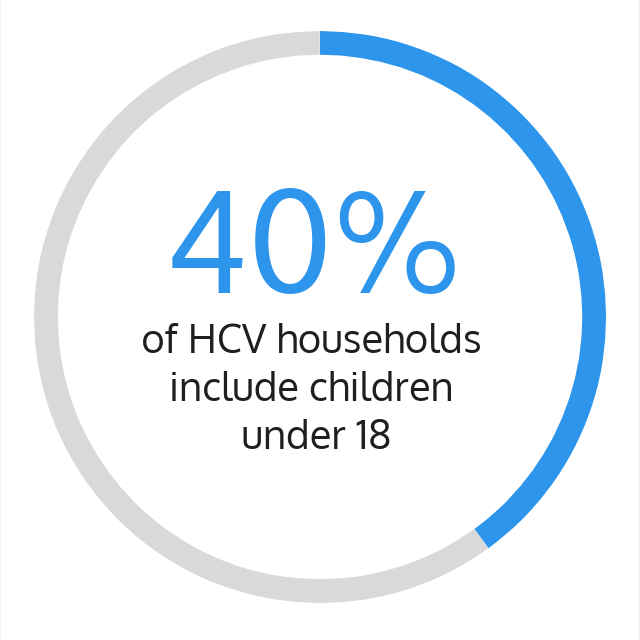

While targeting the most economically disadvantaged households, the HCV program also serves the most vulnerable. In 2018, 53 percent of HCV households were elderly (29 percent) or disabled (24 percent). Forty percent of HCV households included children under the age of 18. Of those non-disabled, non-elderly HCV households, 75 percent were working, worked recently, or likely were subject to work requirements.