A new report from Harvard University’s Joint Center for Housing Studies highlights ongoing affordability challenges among lower-income households, and persistent declines in the availability of low cost rental units. For the fifth year in a row, national rent growth exceeded 3 percent, far outpacing inflation for items other than shelter. The number and share of cost-burdened renters also remains at a near record high, with just over 50 percent of all renter households paying more than 30 percent of their income for rent. Many lower-income renters are also burdened with utility costs, as households earning less than $30,000 spent an average of 7.8 percent of their income on those expenses.

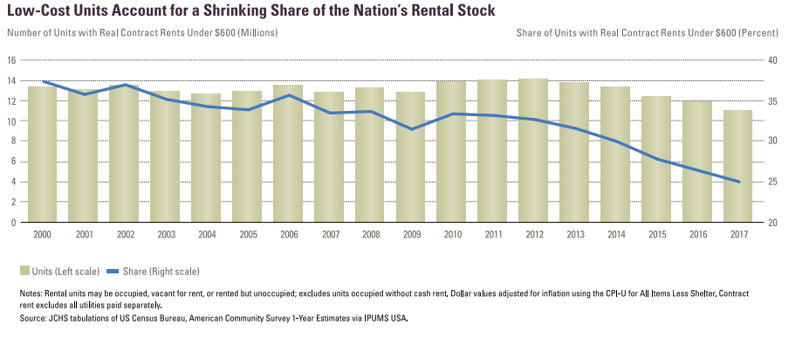

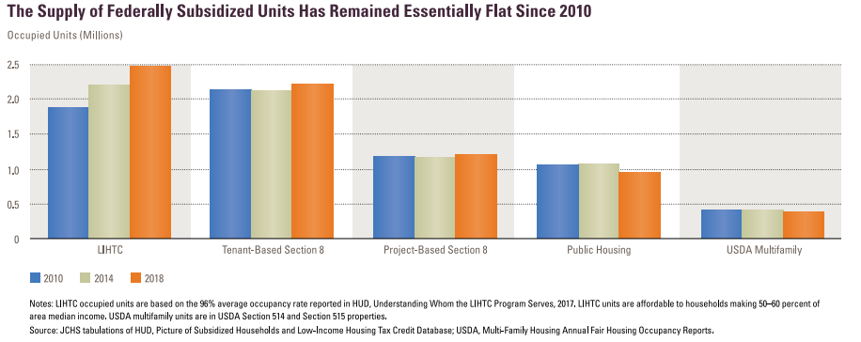

Affordability challenges are being fed by dwindling supply of affordable units nationwide. Since 2018, an additional 410,000 units renting for less than $600 have been lost. According the authors, solutions to affordability and supply challenges will require a number of different solutions, including increased funding for vouchers and public housing preservation, increased affordable housing production through LIHTC financing, and regulatory changes such as zoning reform.